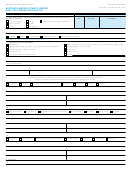

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

BOE-770-DV (S2F) REV. 9 (4-13)

REFUND COMPUTATION WORKSHEET

Use this worksheet to help you complete your claim and calculate the refund due.

Do not send this worksheet with your claim.

(A)

(B)

FROM

DIESEL FUEL

DIESEL FUEL

SECTION A. TAX-PAID CREDITS

SCHEDULE

AT

AT

(Total Gallons)

CURRENT

PRIOR RATE

RATE

1. Tax-paid fuel exported (enter totals from column 11 on Schedule 13A)

13A

2. Tax-paid fuel sold to the United States Government (enter totals from

13C

column 11 on Schedule 13C)

3. Tax-paid fuel sold for use on farms for farming purposes (enter totals

13D

from column 11 on Schedule 13D)

4. Tax-paid fuel sold to exempt bus operators (enter totals from column 11

13E

on Schedule 13E)

5. Tax-paid fuel sold to train operators (enter totals from column 11 on

13G

Schedule 13G)

6. Tax-paid fuel used in an exempt manner not reportable on another credit

13J

schedule (enter totals from column 11 on Schedule 13J)

7. TOTAL TAX-PAID GALLONS CLAIMED FOR REFUND (add lines 1

through 6 for each column) Enter this amount in columns A and B on

line 1 on the front of the claim.

Note: Any schedules required in support of this claim (Schedules 1A, 2A, 12A through 12C, and 13A through 13J) must be

submitted with the claim. You must complete Schedules 1A and 2A, as applicable to your purchases, in support of your claim. If

you are claiming a refund at the prior tax rate, you must have reported your below the rack activities on Schedules 12A, 12B,

and 12C for all previous reporting periods from the period prior to the tax rate change forward through the period on which you

are making the claim. For example, to claim a credit transaction claimed at the prior tax rate in the September 2011 period, you

would need to report on these schedules for the June 2011 period and all subsequent periods. You must also report these

schedule activities for this reporting period.

BOE-810-FTE, Instructions for Preparing Motor Fuels Schedules, is available on our website at

, and provides detailed instructions on the reporting requirements for these schedules.

CLEAR

PRINT

1

1 2

2 3

3 4

4 5

5 6

6