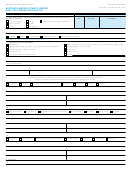

BOE-770-DV (S2B) REV. 9 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

INSTRUCTIONS

DIESEL FUEL ULTIMATE VENDOR REPORT/CLAIM FOR REFUND

GENERAL INFORMATION

Ultimate vendors are persons who sell undyed diesel fuel without tax to an ultimate purchaser for use on a farm for farming

purposes or for use in an exempt bus operation. As an ultimate vendor of diesel fuel in California, you may be reimbursed for tax

you paid on undyed diesel fuel you subsequently sold without tax to ultimate purchasers, farmers who use fuel on a farm for

farming purposes, and exempt bus operators who use the fuel in exempt bus operations. You may also use this form to request

a refund of the tax paid on undyed diesel fuel you exported outside California, sold to the U.S. Government and its agencies or

instrumentalities, sold to train operators, and on tax-paid undyed diesel fuel you used for purposes other than operating

vehicles on highways in this state.

Note: Effective July 1, 2011, the diesel fuel tax rate may be adjusted annually. Due to this annual adjustment, you may have

transactions at several different rates. The effective date of any future rate change will be July 1.

If you are interested in filing your

Diesel Fuel Ultimate Vendor Report/Claim for Refund

electronically with the BOE, please visit

the BOE's website at

for more information.

To obtain the latest information on product codes or if you need help completing this form, please call us at 1-800-400-7115

(TTY:711) or visit the BOE's website at

Filing Requirements

You must file a periodic report with the BOE listing your total diesel fuel purchases. On the same form you may file a claim for

refund of tax you paid on diesel fuel sold or used for the exempt purposes explained above, provided you have not previously

claimed a refund for these same exempt sales on BOE-770-DV or BOE-770-DVW. You must file the report even if you have no

exempt transactions or refunds to claim for the reporting period. The report is due on or before the last day of the month

following the reporting period. Failure to file this periodic report will result in a delay in processing refunds.

Note:

If you are filing a claim for refund, you must complete all appropriate schedules and submit them with this report/claim.

Failure to properly complete the schedules will result in your refund claim not being accepted and the form and all accompanying

documents will be returned to you.

Preparation of Schedules

There are two types of supporting schedules included with every

Diesel Fuel Ultimate Vendor Report/Claim for Refund:

a

standard

Receipt Schedule

and a standard

Disbursement Schedule.

You must select the appropriate schedule code from the

Diesel Fuel Schedule Codes list which is included with these instructions, and enter the schedule code for your activities on the

Receipt or Disbursement Schedules, as indicated. In addition to a schedule code to describe the activity covered, you must

select a product code for the type of product reported and enter the product code on the schedule. For each schedule code

there can be only one product code reported per page for the period. You will need to make a copy of the blank schedules

included with this report/claim for each schedule and product code combination you will be using. For each schedule, complete

the information in boxes (c) and (d) in the header of the schedule. Enter in (c) the schedule code from the Diesel Fuel Schedule

Codes list and, in (d), the product code from the Diesel Fuel Product Codes description table. Enter in (a) the Company Name, in

(b) the Account Number, and in (e) the month and year for which the schedule applies will be completed for you. If they are not

completed, please enter the appropriate information from the face of the report/claim form.

For detailed information regarding the use and preparation of these schedules, see BOE-810-FTE, Instructions for

Preparing Motor Fuels Schedules, available on our website at

Special Note: The following applies to Schedules 13A through 13J. Complete all columns if the fuel is delivered. If fuel is sold

through a cardlock or any retail locations, then you will only need to complete columns 3, and 5 through 11. Refer to

BOE-810-FTE,

Instructions for Preparing Motor Fuels Schedules,

for complete cardlock reporting instructions. When preparing

Schedule 13D,

Fuel Sold for Use on Farms for Farming Purposes,

please be sure to provide the BOE's diesel fuel account

number for the sale for which you are claiming a refund, for example, DF MT 57-xxxxxx instead of the BUYER'S FEIN in column 6

if you have that number.

1

1 2

2 3

3 4

4 5

5 6

6