Form Ct-207k - Insurance/health Care Tax Credit Schedule - 2014 Page 3

ADVERTISEMENT

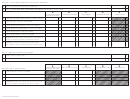

Part 3 - 70% Tax Credit Limitation

00

30. Multiply Line 1 by 70% (.70).

00

31. Add Line 23, Column C and Line 29, Column C.

00

32. Part 3 - 70% Tax Credit Limitation: Subtract Line 31 from Line 30.

A

C

D

E

B

Carryforward Amount From

2014 Credit Amount Claimed

Amount Applied

Carryforward Amount to 2015

Carryback Amount

Part 3A - 70% Tax Credits

Previous Income Years

00

00

00

00

33. Insurance Reinvestment - Form CT-IRF

00

00

00

00

34. Second Insurance Reinvestment - Form CT-SIRF

35. Total Part 3: Add Line 33 and Line 34. The total from

00

00

00

00

Column C must not exceed amount from Line 32.

A

C

D

E

B

Amount Applied

Carryforward Amount to 2015

Carryback Amount

Carryforward Amount From

2014 Credit Amount Claimed

Part 4 - Total Tax Credits

Previous Income Years

00

00

00

00

00

36. Total Tax Credits: Add Line 23, Line 29, and Line 35.

Form CT-207K ( Rev. 06/14 )

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3