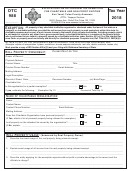

INSTRUCTIONS FOR APPLICATION FOR

FIVE-YEAR AD VALOREM TAX EXEMPTION FOR

OKLAHOMA MANUFACTURING OR RESEARCH AND DEVELOPMENT FACILITIES

(OTC FORM 900XM-R12/12)

Every question must be completed. If additional space is needed to properly answer or explain any item, attach

additional pages and identify as to item or question number. Some questions may not apply in your situation; mark

those questions N/A for not applicable.

Submit one application for each year in which assets were acquired. Since each asset group will have a different

number of years of remaining eligibility, assets acquired in different years must be separated and submitted on

separate applications. In some cases applicants may be filing 5 complete sets of applications, one for each asset

group. Upon completion of application please mail to the county assessor’s office in which the facility is located.

Do not use previous year(s) forms. Use only 900XM Revised Dec 2012 of Oklahoma Tax Commission website.

Page 1 The year in which each asset group was acquired should appear in the upper right hand corner marked

Assets Acquired ______.

Page 1 The tax year for which you are filing the application should appear in the first paragraph in the blank marked

January 1, ___.

Question 1 asks for the North American Industrial Classification System (NAICS) for each specific activity and a

description of the activity. North American Industrial Classification System Manuals are published by the Office of

Management and Budget in Washington D.C., and can be obtained at most libraries. In describing the activity,

please be as descriptive as possible.

You must answer either question 6A, 6B, 6C, 6D to indicate which of the four (4) possible eligible scenarios applies

to your situation if real estate is involved.

Question 7 indicates the amounts of exemption you are claiming on eligible property located in Oklahoma on

January 1. You must be explicit and be able to provide documentation to substantiate the amounts reflected on the

itemized asset list.

Question 8 pertains to leased assets which are eligible if a state of leasehold equity exists. When a lease is

structured as a mortgage or with the lease payments dedicated to debt retirement, the assets may be eligible for the

exemption.

Page 4 is the signature page. Be sure that the signature and notary is correct and current. If other than a Company

officer, Power of Attorney form #BT129 (located on the Oklahoma Tax Commission website), must be attached each

year of the application.

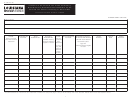

Page 5 is the State of Oklahoma Employment Level and Payroll Affidavit. Complete this form as instructions

indicate. (example attached)

If you are a Distribution Center or Pulp, Paper, Tissue and Paperboard Manufacturer, please contact the Oklahoma

Tax Commission, Ad Valorem Division 405-319-8200, for additional forms, regarding payroll.

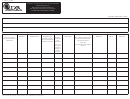

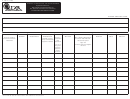

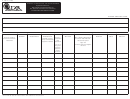

Page 6 is the Personal Property Appraisal Worksheet. List the Item Number, Description of Equipment, Year

Acquired, Investment Cost, Description of Intangible, Intangible Cost and Total LESS Intangible Cost. (example

attached)

*Page 6 Intangible personal property is non-taxable in Oklahoma beginning January 1, 2013.

Any intangible

personal property that is embedded in the qualifying investment amount must be itemized on page 6. The amount

calculated for reimbursement must not contain any intangible personal property value. The investment amount will

not be affected only the amount for local reimbursement.

Intangible personal property must be identified,

documented, and valued by the applicant. The Oklahoma Tax Commission reserves the right to request additional

information.

-a-

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12