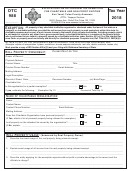

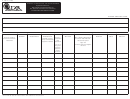

6A.

Is this a concern that was not engaged in business in Oklahoma or did not have property subject to ad valorem taxation

in Oklahoma and constructed a facility or acquired an existing facility which had been unoccupied for 12 months?

YES

NO

If yes, complete the following:

Date last occupied :

Name of former owner or occupant:

Date acquired by applicant:

Date occupied by applicant:

Date construction began:

Date construction completed:

Total costs:

Total square feet of building:

Total land area currently used for manufacturing or research & development:

6B.

Is this a concern that was engaged in business in this state or had property subject to ad valorem taxation in this state

and constructed a facility in Oklahoma at a different location and continued to operate all its facilities in Oklahoma to

January 1 of this year?

YES

NO

If yes, complete the following:

Date construction began:

Date construction substantially completed:

Total costs:

Total square feet of building prior to expansion:

Total sq. feet of building after expansion:

Total area of land in use prior to expansion:

Total area of land in use after expansion:

6C.

Is this a concern that was engaged in business in this state or had property subject to ad valorem taxation in this state

and expanded an existing facility and this exemption is claimed on the expansion of an existing facility?

YES

NO

If yes, complete the following:

Date construction or expansion began:

Date construction or expansion completed:

Total costs:

Total square feet of building prior to expansion:

Total sq. feet of building after expansion:

Total area of land in use prior to expansion:

Total area of land in use after expansion:

6D.

Is this a concern that was engaged in business in this state or had property subject to ad valorem taxation in this state

and acquired an existing facility in Oklahoma which had been unoccupied for 12 months or longer and continued to

operate all its facilities in Oklahoma to January 1 of this year?

YES

NO

If yes, provide the following:

Date last occupied:

Name of former owner or occupant:

Date acquired by applicant:

Date occupied by applicant:

Total costs:

Total square feet of building:

Total land area currently used for manufacturing or research & development:

-2-

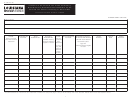

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12