7

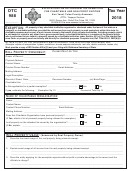

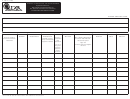

Please indicate property owned at this facility and its value on which qualifying investment is being claimed.

.

Exclude licensed/tagged vehicles.

(USE PAGE 6 WORKSHEET)

ORIGINAL COST OF OWNED

YEAR ACQUIRED OR

OWNED PROPERTY

NEW OR USED

PROPERTY

CONSTRUCTED

LAND

BUILDING

MACHINERY & EQUIPMENT

LEASEHOLD IMPROVEMENT

INTANGIBLE PERSONAL

PROPERTY*

TOTAL INVESTMENT

All cost amounts rendered for machinery or leasehold must be substantiated with itemized lists, giving a

description of the asset, original cost, and year acquired. Please attach the additional pages to this form and

identify as to item or question.

If real or personal property is leased using a lease-purchase agreement, attach a copy of the lease and indicate the

following: (USE PAGE 6 WORKSHEET)

*Intangible personal property is non-taxable in Oklahoma beginning January 1, 2013. Any intangible personal

property that is embedded in the qualifying investment amount must be itemized on page 6. The amount calculated

for reimbursement must not contain any intangible personal property and value. The investment amount will not be

affected only the amount for local reimbursement.

Intangible personal property must be identified, documented,

and valued by the applicant. The Oklahoma Tax Commission reserves the right to request any additional

information

8A.

LEASE REAL AND PERSONAL PROPERTY

CONTRACT PURCHASE AMOUNT

DATE OF TITLE CONVEYANCE

LAND

BUILDINGS

MACHINERY & EQUIPMENT

8A-1

Are lease payments applied to the purchase price?

YES

NO

If no, explain:

EXPLANATION: ___________________________________________________________________

8B.

Is the lease-purchase amount stated in the agreement? YES

NO

If yes, for what amount?

____________________________________

Note 1: If additional space is required for this question, attach an addendum as needed. Specifically list

all leased machinery and equipment by description, model year, and purchase amount.

Note 2: The filing of this application for exemption on certain exempt property does not relieve the

applicant from the responsibility of listing all taxable property with the county assessor.

Note 3:

It will be necessary for Tax Commission personnel to examine the facilities claimed for

exemption.

-3-

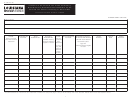

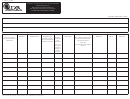

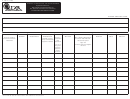

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12