Name (as shown on page 1)

TIN

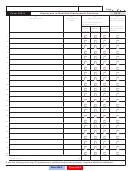

Part 7

Available Credit Carryover

(a)

(b)

(c)

(d)

(e)

33

Taxable year ...............

00

00

00

00

00

34

Original credit amount

35

Amount

00

00

00

00

00

previously used...........

36

Tentative carryover:

Subtract line 35

00

00

00

00

00

from line 34 .................

37

Amount unallowable:

00

00

00

00

00

See instructions ..........

38

Available carryover:

Subtract line 37

00

00

00

00

00

from line 36 .................

00

39

TOTAL AVAILABLE CARRYOVER .................................................................................................................................

39

Total Available Credit

Part 8

40

Current year’s credit for new employment:

• Individuals, corporations, exempt organizations with UBTI, or S corporations: Enter the amount from

Part 4, line 19.

• S corporation shareholders: Enter the amount from Part 5, line 23.

00

• Partners of a partnership: Enter the amount from Part 6, line 29 ...............................................................................

40

Individuals: Also enter this amount on Form 301, Part 1, line 26, column (a).

Corporations, S corporations, and exempt organizations with UBTI: Also enter this amount on

Form 300, Part 1, line 20, column (a).

00

41

41

Available credit carryover from Part 7, line 39, column (e) .............................................................................................

Individuals: Also enter this amount on Form 301, Part 1, line 26, column (b).

Corporations, S corporations, and exempt organizations with UBTI: Also enter this amount on

Form 300, Part 1, line 20, column (b).

00

42

Total available credit: Add lines 40 and 41 ..................................................................................................................

42

Individuals: Also enter total here and on Form 301, Part 1, line 26, column (c).

Corporations, S corporations, and exempt organizations with UBTI: Also enter total here and on

Form 300, Part 1, line 20, column (c).

AZ Form 345 (2014)

ADOR 11149 (14)

Page 3 of 3

Print 345

1

1 2

2 3

3 4

4 5

5