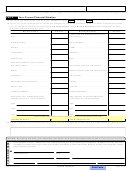

Your Name (as shown on page 1)

Your Social Security Number

If you need more room to write your answer to any question, add more pages. Write your name and social security number on the top of each page you include.

Part 2

Information About You and Your Spouse

(or former spouse)

5

Spouse’s (or former spouse’s) Current Name

Social Security Number (if known)

Current Home Address – number and street, rural route

Apartment Number

Daytime Phone No. (with area code)

City, Town or Post Office

State

ZIP Code

6 What is the current marital status between you and the person on line 5? Check one box:

Married and still living together.

M M D D Y Y Y Y

Married and living apart since:

.

M M D D Y Y Y Y

. Include a photocopy of the death certificate and will,

Widowed since:

if one exists.

M M D D Y Y Y Y

Legally separated since:

. Include a photocopy of your entire separation agreement.

M M D D Y Y Y Y

Divorced since:

. Include a photocopy of your entire divorce decree.

NOTE: A divorce decree stating that your former spouse must pay all taxes does not necessarily mean you qualify for relief.

7 What was the highest level of education you had completed when the return(s) were filed? If the answers are not the same for all

tax years, explain.

High school diploma, equivalent, or less

Some college

College degree or higher. List any degrees you have:

List any college-level business or tax-related courses you completed:

Explain:

8 Were you a victim of spousal abuse or domestic violence during any of the tax years you want relief? If the answers are not the

same for all tax years, explain.

Yes. Include a statement to explain the situation and when it started. Provide photocopies of any documentation,

such as police reports, a restraining order, a doctor’s report or letter, or a notarized statement from someone who was

aware of the situation.

No.

9 Did you sign the return(s)? If the answers are not the same for all tax years, explain.

Yes. If you were forced to sign under duress (threat of harm or other form of coercion), check this box:

. See instructions.

No. Your signature was forged. See instructions.

10 When any of the returns were signed, did you have a mental or physical health problem, or do you have a mental or physical

health problem now? If the answers are not the same for all tax years, explain.

Yes. Include a statement to explain the problem and when it started. Provide photocopies of any documentation,

such as medical bills or a doctor’s report or letter.

No.

Continued on page 3

ADOR 10180 (14)

Page 2 of 5

AZ Form 200 (2014)

1

1 2

2 3

3 4

4 5

5