Your Name (as shown on page 1)

Your Social Security Number

If you need more room to write your answer to any question, add more pages. Write your name and social security number on the top of each page you include.

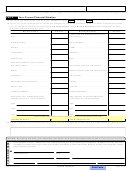

Part 3

Your Financial and Return Preparation Involvement

11 How were you involved with preparing the returns? Check all that apply and explain, if necessary. If the answers are not the

same for all tax years, explain:

You filled out or helped fill out the returns.

You gathered receipts and cancelled checks.

You gave the tax documents (such as Forms W-2, 1099, etc.) to the person who prepared the returns.

You reviewed the returns before they were signed.

You did not review the returns before they were signed. Explain below.

You were not involved in preparing the returns.

Other:

Explain how you were involved:

12 When the returns were signed, were you concerned that any of the returns were incorrect or missing information? Check all that

apply and explain, if necessary. If the answers are not the same for all tax years, explain:

You knew something was incorrect or missing, but you said nothing.

You knew something was incorrect or missing and asked about it.

You did not know anything was incorrect or missing.

Explain:

13 When any of the returns were signed, what did you know about the income of the person on line 5? If the answers are not the

same for all tax years, explain:

You knew that person had income.

List each type of income on a separate line. (Examples are wages, social security, gambling winnings, or self-employment business income.)

Enter each tax year and the amount of income for each type listed. If you don’t know any details, enter, “I don’t know.”

Type of Income

Who paid it to that person?

Tax Year 1

Tax Year 2

Tax Year 3

$

$

$

$

$

$

$

$

$

You knew that person was self-employed and you helped with the books and records.

You knew that person was self-employed and you did not help with the books and records.

You knew that person had no income.

You did not know if that person had income.

Explain:

14 When the returns were signed, did you know any amount was owed to the department for those tax years? If the answers are not

the same for all tax years, explain.

Yes. Explain when and how you thought the amount of tax reported on the return would be paid:

No. Explain:

Continued on page 4

ADOR 10180 (14)

Page 3 of 5

AZ Form 200 (2014)

1

1 2

2 3

3 4

4 5

5