Your Name (as shown on page 1)

Your Social Security Number

If you need more room to write your answer to any question, add more pages. Write your name and social security number on the top of each page you include.

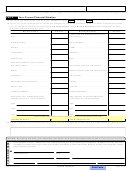

Part 4

Your Current Financial Situation

18 Tell us the number of people currently in your household: Adults

Children

19 Tell us your current average monthly income and expenses for your entire household. If family or friends are helping to support

you, include the amount of support as gifts under Monthly Income. Under Monthly Expenses, enter all expenses, including

expenses paid with income from gifts.

Monthly Income

Amount

Monthly Expenses

Amount

Federal, state, and local taxes deducted from

$

$

Gifts ...................................................................

your paycheck ..................................................

$

$

Wages (gross pay) ............................................

Rent or mortgage .............................................

$

$

Pensions ............................................................

Utilities .............................................................

$

$

Unemployment ..................................................

Telephone ........................................................

$

$

Social security ...................................................

Food .................................................................

Government assistance, such as housing,

$

$

food stamps, grants ...........................................

Car expenses, payments, insurance etc. ..........

$

$

Alimony ..............................................................

Medical expenses, including medical insurance

$

$

Child support .....................................................

Life insurance ..................................................

$

$

Self-employment business income ....................

Clothing ............................................................

$

$

Rental income ....................................................

Child care .........................................................

$

$

Interest and dividends .......................................

Public transportation ........................................

Other income, such as disability payments,

Other expenses, such as real estate taxes,

gambling winnings, etc. List the type below:

child support, etc. List the type below:

$

$

Type:

Type:

$

$

Type:

Type:

$

$

Type:

Type:

Yellow-colored fields calculate and are read-only. You cannot enter data in these fields.

$

$

Total Monthly Income ......................................

Total Monthly Expenses ................................

20 Please provide any other information you want us to consider in determining whether it would be unfair to hold you liable for the

tax:

CAUTION: By signing this form, you understand that, by law, we must contact the person on line 5. See instructions for line 5.

Under penalties of perjury, I declare that I have examined this form and any accompanying schedules and statements, and to the best of my

knowledge and belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which

preparer has any knowledge.

YOUR SIGNATURE

DATE

PAID PREPARER’S SIGNATURE

DATE

FIRM’S NAME (PREPARER’S IF SELF-EMPLOYED)

PAID PREPARER’S TIN

PAID PREPARER’S ADDRESS

PAID PREPARER’S PHONE NUMBER

ADOR 10180 (14)

Page 5 of 5

AZ Form 200 (2014)

Print Form

1

1 2

2 3

3 4

4 5

5