Supplemental Schedule Ct-1040wh - Connecticut Income Tax Withholding - 2015

ADVERTISEMENT

Department of Revenue Services

Supplemental Schedule CT-1040WH

2015

State of Connecticut

Connecticut Income Tax Withholding

(Rev. 12/15)

1040WH 00 15W 01 9999

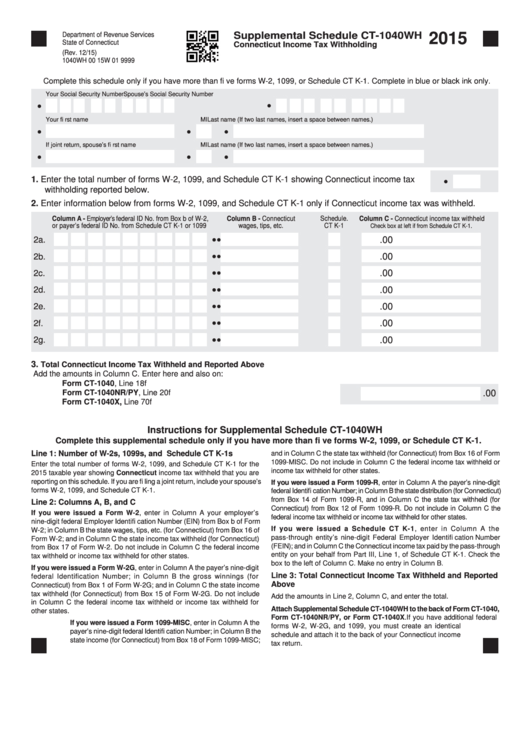

Complete this schedule only if you have more than fi ve forms W-2, 1099, or Schedule CT K-1. Complete in blue or black ink only.

Your Social Security Number

Spouse’s Social Security Number

Your fi rst name

MI

Last name (If two last names, insert a space between names.)

If joint return, spouse’s fi rst name

MI

Last name (If two last names, insert a space between names.)

1. Enter the total number of forms W-2, 1099, and Schedule CT K-1 showing Connecticut income tax

withholding reported below.

2. Enter information below from forms W-2, 1099, and Schedule CT K-1 only if Connecticut income tax was withheld.

Column A - Employer’s federal ID No. from Box b of W-2,

Column B - Connecticut

Schedule.

Column C - Connecticut income tax withheld

or payer’s federal ID No. from Schedule CT K-1 or 1099

wages, tips, etc.

CT K-1

Check box at left if from Schedule CT K-1.

.00

2a.

.00

2b.

.00

2c.

2d.

.00

.00

2e.

.00

2f.

.00

2g.

3.

Total Connecticut Income Tax Withheld and Reported Above

Add the amounts in Column C. Enter here and also on:

Form CT-1040, Line 18f

Form CT-1040NR/PY, Line 20f

.00

Form CT-1040X, Line 70f

Instructions for Supplemental Schedule CT-1040WH

Complete this supplemental schedule only if you have more than fi ve forms W-2, 1099, or Schedule CT K-

1.

Line 1: Number of W-2s, 1099s, and Schedule CT K-1s

and in Column C the state tax withheld (for Connecticut) from Box 16 of Form

1099-MISC. Do not include in Column C the federal income tax withheld or

Enter the total number of forms W-2, 1099, and Schedule CT K-1 for the

income tax withheld for other states.

2015 taxable year showing Connecticut income tax withheld that you are

reporting on this schedule. If you are fi ling a joint return, include your spouse’s

If you were issued a Form 1099-R, enter in Column A the payer’s nine-digit

forms W-2, 1099, and Schedule CT K-1.

federal Identifi cation Number; in Column B the state distribution (for Connecticut)

from Box 14 of Form 1099-R, and in Column C the state tax withheld (for

Line 2: Columns A, B, and C

Connecticut) from Box 12 of Form 1099-R. Do not include in Column C the

If you were issued a Form W-2, enter in Column A your employer’s

federal income tax withheld or income tax withheld for other states.

nine-digit federal Employer Identifi cation Number (EIN) from Box b of Form

If you were issued a Schedule CT K-1, enter in Column A the

W-2; in Column B the state wages, tips, etc. (for Connecticut) from Box 16 of

pass-through entity’s nine-digit Federal Employer Identifi cation Number

Form W-2; and in Column C the state income tax withheld (for Connecticut)

(FEIN); and in Column C the Connecticut income tax paid by the pass-through

from Box 17 of Form W-2. Do not include in Column C the federal income

entity on your behalf from Part III, Line 1, of Schedule CT K-1. Check the

tax withheld or income tax withheld for other states.

box to the left of Column C. Make no entry in Column B.

If you were issued a Form W-2G, enter in Column A the payer’s nine-digit

Line 3: Total Connecticut Income Tax Withheld and Reported

federal Identification Number; in Column B the gross winnings (for

Above

Connecticut) from Box 1 of Form W-2G; and in Column C the state income

tax withheld (for Connecticut) from Box 15 of Form W-2G. Do not include

Add the amounts in Line 2, Column C, and enter the total.

in Column C the federal income tax withheld or income tax withheld for

Attach Supplemental Schedule CT-1040WH to the back of Form CT-1040,

other states.

Form CT-1040NR/PY, or Form CT-1040X. If you have additional federal

If you were issued a Form 1099-MISC, enter in Column A the

forms W-2, W-2G, and 1099, you must create an identical

payer’s nine-digit federal Identifi cation Number; in Column B the

schedule and attach it to the back of your Connecticut income

state income (for Connecticut) from Box 18 of Form 1099-MISC;

tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1