Supplemental Schedule Ct-1040wh - Connecticut Income Tax Withholding - 2013

ADVERTISEMENT

Department of Revenue Services

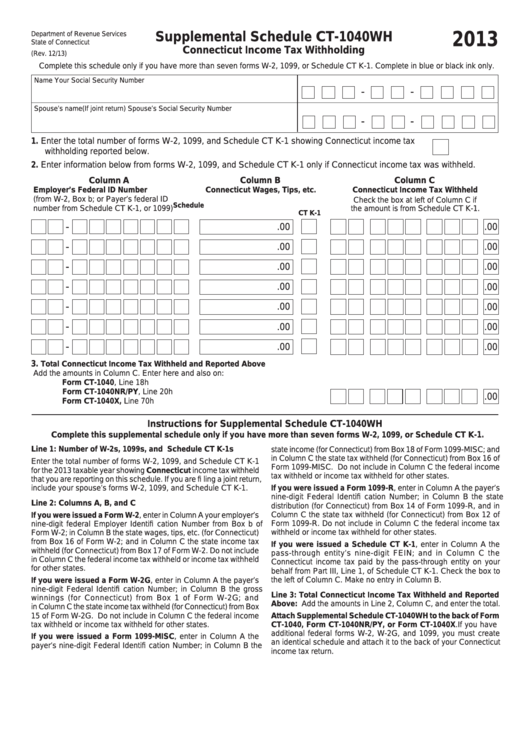

Supplemental Schedule CT-1040WH

2013

State of Connecticut

Connecticut Income Tax Withholding

(Rev. 12/13)

Complete this schedule only if you have more than seven forms W-2, 1099, or Schedule CT K-1. Complete in blue or black ink only.

Name

Your Social Security Number

–

–

Spouse’s name (If joint return)

Spouse’s Social Security Number

–

–

1. Enter the total number of forms W-2, 1099, and Schedule CT K-1 showing Connecticut income tax

withholding reported below.

2. Enter information below from forms W-2, 1099, and Schedule CT K-1 only if Connecticut income tax was withheld.

Column A

Column B

Column C

Connecticut Wages, Tips, etc.

Employer’s Federal ID Number

Connecticut Income Tax Withheld

(from W-2, Box b; or Payer’s federal ID

Check the box at left of Column C if

Schedule

number from Schedule CT K-1, or 1099)

the amount is from Schedule CT K-1.

CT K-1

.00

.00

–

.00

.00

–

.00

.00

–

.00

.00

–

.00

.00

–

.00

.00

–

.00

.00

–

3.

Total Connecticut Income Tax Withheld and Reported Above

Add the amounts in Column C. Enter here and also on:

Form CT-1040, Line 18h

Form CT-1040NR/PY, Line 20h

.00

Form CT-1040X, Line 70h

Instructions for Supplemental Schedule CT-1040WH

1.

Complete this supplemental schedule only if you have more than seven forms W-2, 1099, or Schedule CT K-

Line 1: Number of W-2s, 1099s, and Schedule CT K-1s

state income (for Connecticut) from Box 18 of Form 1099-MISC; and

in Column C the state tax withheld (for Connecticut) from Box 16 of

Enter the total number of forms W-2, 1099, and Schedule CT K-1

Form 1099-MISC. Do not include in Column C the federal income

for the 2013 taxable year showing Connecticut income tax withheld

tax withheld or income tax withheld for other states.

that you are reporting on this schedule. If you are fi ling a joint return,

include your spouse’s forms W-2, 1099, and Schedule CT K-1.

If you were issued a Form 1099-R, enter in Column A the payer’s

nine-digit Federal Identifi cation Number; in Column B the state

Line 2: Columns A, B, and C

distribution (for Connecticut) from Box 14 of Form 1099-R, and in

Column C the state tax withheld (for Connecticut) from Box 12 of

If you were issued a Form W-2, enter in Column A your employer’s

Form 1099-R. Do not include in Column C the federal income tax

nine-digit federal Employer Identifi cation Number from Box b of

withheld or income tax withheld for other states.

Form W-2; in Column B the state wages, tips, etc. (for Connecticut)

from Box 16 of Form W-2; and in Column C the state income tax

If you were issued a Schedule CT K-1, enter in Column A the

withheld (for Connecticut) from Box 17 of Form W-2. Do not include

pass-through entity’s nine-digit FEIN; and in Column C the

in Column C the federal income tax withheld or income tax withheld

Connecticut income tax paid by the pass-through entity on your

for other states.

behalf from Part III, Line 1, of Schedule CT K-1. Check the box to

the left of Column C. Make no entry in Column B.

If you were issued a Form W-2G, enter in Column A the payer’s

nine-digit Federal Identifi cation Number; in Column B the gross

Line 3: Total Connecticut Income Tax Withheld and Reported

winnings (for Connecticut) from Box 1 of Form W-2G; and

Above: Add the amounts in Line 2, Column C, and enter the total.

in Column C the state income tax withheld (for Connecticut) from Box

15 of Form W-2G. Do not include in Column C the federal income

Attach Supplemental Schedule CT-1040WH to the back of Form

tax withheld or income tax withheld for other states.

CT-1040, Form CT-1040NR/PY, or Form CT-1040X. If you have

additional federal forms W-2, W-2G, and 1099, you must create

If you were issued a Form 1099-MISC, enter in Column A the

an identical schedule and attach it to the back of your Connecticut

payer’s nine-digit Federal Identifi cation Number; in Column B the

income tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1