Form Ct-2210 - Underpayment Of Estimated Income Tax By Individuals, Trusts, And Estates - 2015 Page 10

ADVERTISEMENT

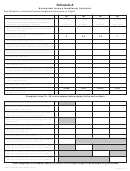

Line c: Subtract Line b from Line a in Column 2 and enter the result

in Column 2. Multiply Column 2 by Column 3 and enter the result

in Column 4.

Line d: Follow the instructions for Line b.

Line e: Add all amounts in Column 4. Enter the total on Form

CT-2210, Part III, Line 17, Column A.

Worksheets B and D

Lines a through d: Follow the instructions for Lines a through d

on Worksheet A.

Line e: Subtract Line d from Line c in Column 2 and enter the result

in Column 2. Multiply Column 2 by Column 3 and enter the result

in Column 4.

Line f: Enter in Column 2 the amount paid during the period listed in

Column 1. If multiple payments were made during the period listed,

combine those payments and enter the total.

Line g: Add all amounts in Column 4. Enter the total on Form

CT-2210, Part III, Line 17, Column B, or Part III, Line 17, Column D.

Worksheet C

Lines a through d: Follow the instructions for Lines a through d

on Worksheet A.

Lines e and f: Follow the instructions for Lines e and f on Worksheets

B and D.

Line g: Subtract Line f from Line e in Column 2 and enter the result

in Column 2. Multiply Column 2 by Column 3 and enter the result

in Column 4.

Line h: Enter in Column 2 the amount paid during the period listed in

Column 1. If multiple payments were made during the period listed,

combine those payments and enter the total.

Line i: Add all amounts in Column 4. Enter the total on Form

CT-2210, Part III, Line 17, Column C.

Form CT-2210 Instructions (Rev. 12/15)

Page 10 of 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10