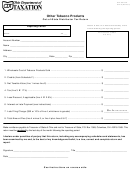

OTP 6

Rev. 10/13

Instructions for Other Tobacco Products Tax Return

Page 2

Other tobacco products and little cigars must now be reported

Line 4 – Multiply line 3 by 17%.

separately beginning with the reporting period including

Line 7 – Line 5 minus line 6.

Oct. 1, 2013.

Line 8 – Multiply line 7 by 37%.

General Instructions – Every out-of-state distributor of

other tobacco products and little cigars must complete and

Line 9 – Add lines 4 and 8.

fi le this tax return for each period whether or not there are any

Line 10 – If the return is received by the Ohio Department

transactions to report. Mail the return, supporting schedules

of Taxation by the last day of the month following the report-

and payment to Ohio Department of Taxation, P.O. Box 530,

ing period, you are entitled to a 2.5% discount. If you qualify

Columbus, OH 43216-0530. The tax return and payment

for the discount, multiply line 9 by 2.5%. Postmarks prior to

must be received by the last day of the month following the

the last day of the month are not acceptable to qualify you

reporting period.

for the discount.

Lines 1 and 5 – Enter the wholesale price of the tobacco

Line 11 – If your tax liability is not paid on or before the due

products and little cigars that were sold into Ohio upon

date, you are subject to interest from the date the tax report

which you will be paying the excise tax for the stated period.

was due until the date the tax report was actually received.

Complete Schedule H, Sales of Other Tobacco Products to

The interest rate is determined on a calendar year basis and

Ohio Retailers or Consumers; Schedule H-LC, Sales of Little

can change from year to year. Please refer to our Web site

Cigars to Ohio Retailers or Consumers; Schedule I, Sales

at tax.ohio.gov for the current interest rate. An example

of Other Tobacco Products for Sale in Ohio to Licensed

of an interest calculation is as follows:

Distributors; and Schedule I-LC, Sales of Little Cigars for

Sale in Ohio to Licensed Distributors. Enter the totals from

Tax due:

$5,000

Schedules H and I on line 1 and the totals from Schedules

Report due:

2/28/13

H-LC and I-LC on line 5. “Wholesale price” means the

Report fi led:

4/19/13

invoice price, including all federal excise taxes, at which

Days late:

50

the manufacturer of the tobacco product sells the tobacco

Interest rate:

3% (rate for year 2013)

product to unaffi liated distributors, excluding any discounts

based on the method of payment of the invoice or on time

50 days

of payment of the invoice. “Other tobacco products” means

X 3% (.03) X $5,000 = $20.55 interest

any product made from tobacco, other than cigarettes,

365 days

that is made for smoking or chewing, or both, and snuff

(excluding cigarette paper). Little cigars are defi ned as any

Line 12 – If your tax return is not received by the due date,

roll for smoking, other than cigarettes, made wholly or in part

you may be billed for a late fi ling charge of $50 or 10% of the

of tobacco that uses an integrated cellulose acetate fi lter

tax due, whichever is greater.

or other fi lter and is wrapped in any substance containing

Line 13 – Line 9 minus line 10 OR line 9 plus line 11 plus line

tobacco, other than natural leaf tobacco.

12. Make check or money order payable to Ohio Treasurer

Lines 2 and 6 – Complete Schedules F and F-LC by entering

of State, write your account number and reporting period on

the wholesale price as defi ned above (not your selling price)

your remittance, and mail to the listed address.

of other tobacco products and little cigars that were returned

If you have any questions concerning Ohio’s other tobacco

to you by your Ohio customers and upon which the excise

products tax, please contact the Ohio Department of Taxation,

tax was previously paid. Enter the total from all Schedule Fs

Excise and Energy Tax Division, P.O. 530, Columbus, OH

on line 2 and from all Schedule F-LCs on line 6.

43216-0530, or call us at (855) 466-3921, option 3.

Line 3 – Line 1 minus line 2.

1

1 2

2