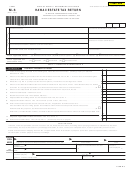

Part 1. Tentative Massachusetts Estate Tax

1 Total gross estate. Enter the amount from the July 1999 revision of U.S. Form 706, page 1, line 1. . . . . . . . . . . . . . . . . . 3 1

2 Credit for state death taxes. Enter the amount from the July 1999 revision of U.S. Form 706, page 1, line 15. If this return is for the estate of a

Massachusetts resident decedent who did not own real estate and/or tangible personal property in another state, omit Parts 2 and 3 and enter

this amount in Part 4, line 1. If this return is for the estate of a Massachusetts resident decedent who owned real estate and/or tangible personal

property in other states, complete Parts 2 and 4 and omit Part 3. If this return is for the estate of a nonresident

decedent with Massachusetts property, omit Part 2 and complete Parts 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

Part 2. Computation of Tax for Estate of Massachusetts Resident Decedent

with Property in Another State

1 Total gross estate, wherever situated. Enter the amount from Part 1, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

2 Credit for state death taxes. Enter the amount from Part 1, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

3 Estate or inheritance taxes actually paid to other states . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

4 Gross value of real estate and tangible personal property in other states. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Percentage of estate in other states. Divide line 4 by line 1. Note: Complete computation to six decimal places. . . . . . . . 3 5

.

6 Prorated credit. Multiply line 2 by line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Deduction allowable for taxes paid to other states. Enter the smaller of line 3 or line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Massachusetts estate tax. Subtract line 7 from line 2. Enter result here and in Part 4, line 1 . . . . . . . . . . . . . . . . . . . . . . . . 3 8

Part 3. Computation of Tax for Estate of Nonresident Decedent with

Massachusetts Property

1 Total gross estate, wherever situated. Enter the amount from Part 1, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

2 Credit for state death taxes. Enter the amount from Part 1, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

3 Gross value of real estate and tangible personal property in Massachusetts. Enter the total

reported on Form M-NRA, line 26. Do not deduct the value of any mortgage or lien . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

4 Percentage of estate in Massachusetts. Divide line 3 by line 1. Note: Complete computation to six decimal places . . . . . 3 4

.

5 Massachusetts nonresident estate tax. Multiply line 2 by line 4. Enter result here and in Part 4, line 1 . . . . . . . . . . . . . . . . 3 5

Part 4. Massachusetts Estate Tax Due

1 Massachusetts estate tax. Enter the amount from Part 1, line 2, Part 2, line 8 or Part 3, line 5, whichever applies. . . . . . . 3 1

2 Late file and/or late pay penalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

3 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

4 Total amount due. Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Payments made with extension. Attach a copy of Form M-4768 and/or Form M-4768A. . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

6 Other amounts previously paid. Attach copies of any prior filings with payment dates and amounts . . . . . . . . . . . . . . . . . . 3 6

7 Total payments. Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Overpayment. If line 4 is smaller than line 7, subtract line 4 from line 7. This is the amount of your refund. If line 4 is

larger than line 7, omit line 8 and complete line 9. If lines 4 and 7 are equal, enter “0” in line 8 and omit line 9 . . . . . . . . . 3 8

9 Balance due. If line 4 is larger than line 7, subtract line 7 from line 4. This is the amount of the payment due at time

of filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 9

Make check payable to Commonwealth of Massachusetts. Mail to: Massachusetts Department of Revenue, Bureau of Desk Audit, Estate Tax

Unit, PO Box 7023, Boston, MA 02204. Deliver to: Massachusetts Department of Revenue, Bureau of Desk Audit, Estate Tax Unit, 200 Arlington

St., Rm. 4300, Chelsea, MA 02150.

1

1 2

2