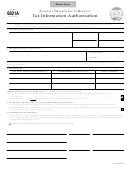

SPECIFIC INSTRUCTIONS

ITEM 1, NAME AND ADDRESS OF TAXPAYER. If the taxpayer is an individual, the social security number must be

entered. If a joint tax return has been filed, enter both social security numbers in the spaces provided.

If the taxpayer is a corporation, partnership, or association, enter the name, state and federal identification numbers (if

applicable), and the business address.

If Form 8821N will be used in a tax matter in the case of a partnership for which the names, addresses, and social security

numbers or identification numbers of the partners have not already been furnished to the Department, these items should be

listed on an attached sheet.

If the taxpayer is an estate or trust, enter the name, title, and address of the fiduciary, as well as the name and identification

number or social security number of the taxpayer

If space is used to list information other than that designated for that space, clearly label the change.

ITEM 2, TYPE OF TAX, FORM NUMBER(S), YEAR(S) OR PERIOD(S). Form 8821N is designed to clearly express

the scope of the authority granted by the taxpayer to the appointee. In the space provided, designate all types of taxes, form

numbers, and years or periods for which this authorization is being granted. Reference can be made to “all years,” or “all

periods.” As many as four entries may be listed on one form. If the matter relates to an estate tax, enter the date of the decedent’s

death instead of the year or other period.

ITEMS 3 AND 4, DISCLOSURE OF TAX INFORMATION. Form 8821N lists two acts which relate to the appointee. Please

check the appropriate boxes. If the taxpayer wishes to authorize an act which is not listed, a concise and specific statement

of the additional authorization should be attached.

ITEM 5, SIGNATURE. The taxpayer must sign and date the form on the lines provided. If a husband and wife file a joint

return which both have signed, either spouse may sign Form 8821N. A person may not, however, authorize another party or

themselves to exchange confidential tax information in regard to separate returns filed by the person’s spouse.

If the taxpayer is a partnership, all partners must sign unless one is duly authorized to act in the name of the partnership.

Nebraska has adopted the Uniform Partnership Act (Neb. Rev. Stat. § 67-309, R.R.S. 2003), which makes each partner a

business agent duly authorized to act for the partnership. This governs partnerships formed in the state of Nebraska. The

validity of authorizations made by nonresident partnerships will be determined by the law of the state in which the partnership

was formed.

If the taxpayer is a corporation or an association, an officer having authority to bind the entity must sign. The officer must

indicate his or her official title on the line provided.

1

1 2

2