Form Rpd-41377 - Manufacturers Agreement To Pay Gross Receipts Tax On Behalf Of A Utility Company For Certain Utility Sales Page 3

ADVERTISEMENT

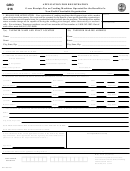

State of New Mexico - Taxation and Revenue Department

RPD-41377

Int. 12/31/2012

Manufacturers Agreement to Pay Gross Receipts Tax

on Behalf of a Utility Company for Certain Utility Sales

Instructions

About this Deduction. For purchases of utilities made

must submit Form RPD-41378, Application for Type 11

on or after January 1, 2013, a deduction is available for

or Type 12 Nontaxable Transaction Certificates, and this

receipts from selling tangible personal property that is

agreement, Form RPD-41377, Manufacturers Agree-

ment to Pay Gross Receipts Tax on Behalf of a Utility

used in such a way that it is consumed in the manufac-

turing process of a product, provided that it is not a tool

Company for Certain Utility Sales. The manufacturing

or equipment used to create the manufactured prod-

business and the utility company must both sign the

uct. The sale must be made to a person engaged in the

agreement, Form RPD-41377. The utility company may

business of manufacturing a product and the manufac-

not take the deduction until the manufacturer executes

turer must deliver a nontaxable transaction certificate

a Type 12 NTTC to the utility company.

(NTTC) to the seller. The deduction is also available for

The application for a Type 12 NTTC must also include

utilities consumed in the manufacturing process. In or-

the appropriate section of RPD-41378, based on the

der to take advantage of the deduction for utilities con-

type of utility consumed. Include:

sumed in the manufacturing process, the manufacturer

• Section E, if electricity is consumed in the manu-

must apply for a Type 12 NTTC, and issue the NTTC

facturing process;

to the utility company. This document is required to be

• Section G, if natural gas is consumed in the manu-

submitted when the manufacturer applies for the Type

facturing process;

12 NTTC.

• Section W, if water is consumed in the manufactur-

For information on a deduction for tangible personal

ing process, or

property, other than a utility, consumed in the manu-

• Section O, if any other utility is consumed in the

facturing of a product, see Form RPD-41378, Applica-

manufacturing process.

tion for Type 11 or Type 12 Nontaxable Transaction Cer-

For more information for the application process for a

tificates.

Type 12 NTTC and reporting requirements, see Form

RPD-41378, Application for Type 11 and Type 12 Non-

Effective Date of This Agreement

taxable Transaction Certificates.

Enter the beginning date of the period for which this

agreement is effective. The period cannot begin pri-

Reporting Requirements of the Utility Company

or to January 1, 2013. This agreement is effective for

three years from the effective date of this agreement. A

The utility company that has signed this agreement and

new agreement must be established and a new Type 12

has been executed a Type 12 NTTC by the manufac-

NTTC must be obtained and executed for periods that

turer, reports the gross receipts of the utilities sold to

extend beyond the dates of this agreement.

the manufacturer and deducts 100% of the receipts in

Column E on their CRS-1 Form. The utility company

Applying For Type 12 NTTCs

reports the receipts separately from other receipts and

If the manufacturer applying for the Type 12 NTTC

must use location code “D0-003” in Column C on their

has more than one manufacturing facility, a new Form

CRS-1 Form.

RPD-41377 must be completed for each location. If the

manufacturer consumes more than one utility in the

Reporting Requirement of the Manufacturer

manufacturing process, a new Form RPD-41377 must

The manufacturer that has signed this agreement and

be completed for each utility. The manufacturer and the

has executed a Type 12 NTTC to the utility company

utility company must verify the purchaser, the physical

is also required to report the utility company’s sales on

location of the manufacturing facility based on the me-

their CRS-1 Form using a special method. The manu-

ter location, the account number that the utility compa-

facturer’s special reporting requirements are described

ny uses to bill the purchaser, and the type of utility sold.

on Form RPD-41378, Application for Type 11 or Type 12

When applying for the Type 12 NTTC for utilities con-

Nontaxable Transaction Certificates.

sumed in the manufacturing process, the applicant

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3