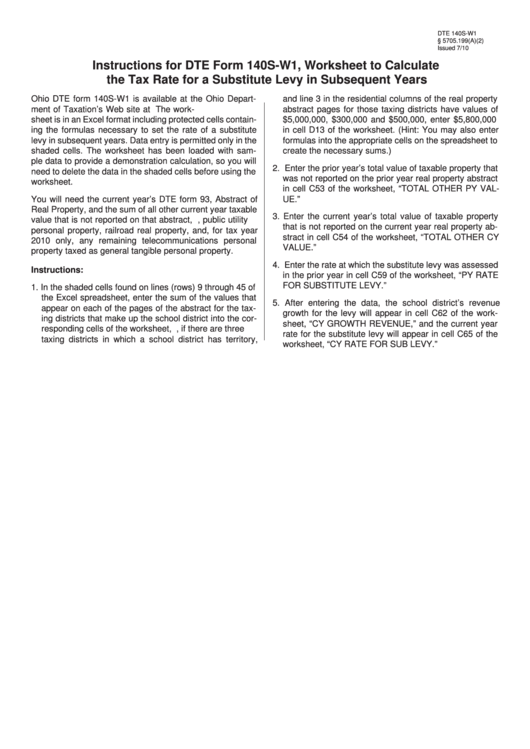

Instructions For Dte Form 140s-W1, Worksheet To Calculate The Tax Rate For A Substitute Levy In Subsequent Years

ADVERTISEMENT

DTE 140S-W1

R.C. § 5705.199(A)(2)

Issued 7/10

Instructions for DTE Form 140S-W1, Worksheet to Calculate

the Tax Rate for a Substitute Levy in Subsequent Years

Ohio DTE form 140S-W1 is available at the Ohio Depart-

and line 3 in the residential columns of the real property

ment of Taxation’s Web site at tax.state.oh.us. The work-

abstract pages for those taxing districts have values of

sheet is in an Excel format including protected cells contain-

$5,000,000, $300,000 and $500,000, enter $5,800,000

ing the formulas necessary to set the rate of a substitute

in cell D13 of the worksheet. (Hint: You may also enter

levy in subsequent years. Data entry is permitted only in the

formulas into the appropriate cells on the spreadsheet to

shaded cells. The worksheet has been loaded with sam-

create the necessary sums.)

ple data to provide a demonstration calculation, so you will

2. Enter the prior year’s total value of taxable property that

need to delete the data in the shaded cells before using the

was not reported on the prior year real property abstract

worksheet.

in cell C53 of the worksheet, “TOTAL OTHER PY VAL-

You will need the current year’s DTE form 93, Abstract of

UE.”

Real Property, and the sum of all other current year taxable

3. Enter the current year’s total value of taxable property

value that is not reported on that abstract, i.e., public utility

that is not reported on the current year real property ab-

personal property, railroad real property, and, for tax year

stract in cell C54 of the worksheet, “TOTAL OTHER CY

2010 only, any remaining telecommunications personal

VALUE.”

property taxed as general tangible personal property.

4. Enter the rate at which the substitute levy was assessed

Instructions:

in the prior year in cell C59 of the worksheet, “PY RATE

FOR SUBSTITUTE LEVY.”

1. In the shaded cells found on lines (rows) 9 through 45 of

the Excel spreadsheet, enter the sum of the values that

5. After entering the data, the school district’s revenue

appear on each of the pages of the abstract for the tax-

growth for the levy will appear in cell C62 of the work-

ing districts that make up the school district into the cor-

sheet, “CY GROWTH REVENUE,” and the current year

responding cells of the worksheet, e.g., if there are three

rate for the substitute levy will appear in cell C65 of the

taxing districts in which a school district has territory,

worksheet, “CY RATE FOR SUB LEVY.”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1