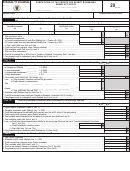

101

SCHEDULE RCT-

KOZ/KOEZ/KOIZ/SDA INSTRUCTIONS

To be completed by businesses subject to the capital

KOZ/KOEZ must be completed and submitted as

stock/foreign franchise tax or corporate net income

part of form RCT-101.

tax that are approved for tax benefits under the

A copy of the letter from the Department of

Keystone Opportunity Zone (KOZ), Keystone

Community and Economic Development approving

Opportunity Expansion Zone (KOEZ), Keystone

the taxpayer for benefits from one of these programs

Opportunity Improvement Zone (KOIZ) or Strategic

for the current tax year must be filed with the

Development Area (SDA) program.

RCT-101.

Important: This schedule is not to be used by

Taxpayers claiming benefits from any of these

entities involved in the operation of a railroad,

programs must check the “KOZ/EIP/SDA” Box on

truck, bus or airline company; pipeline or natural

Page 1 of the RCT-101.

gas company; or water transportation company.

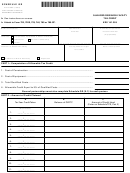

Important: Beginning Jan. 1, 2009, the calculation

Business taxpayers that qualify for KOZ, KOEZ,

of the KOZ/KOEZ/KOIZ credit no longer includes the

KOIZ or SDA benefits MUST first complete the PA

sales factor. The sales factor is still included in the

Corporate Tax Report, RCT-101, without taking into

calculation of the SDA credit.

account any KOZ, KOEZ, KOIZ or SDA benefits to

Failure to provide these documents will result in a

which they might be entitled.

delay in the processing of the credit and may result

In order to calculate a tax credit to be applied against

in an assessment for underpayment of tax reported

the permitted taxes, special schedule RCT-101

on the RCT-101.

COMPLETION OF THE FORM

Indicate the applicable program from which

(A) The person's service is performed entirely

KOZ/KOEZ/KOIZ or SDA benefits are claimed.

within the subzone, expansion subzone or

SDA;

Property Apportionment Factor

Within Subzone, Expansion Subzone or SDA — The

(B) The person's service is performed within and

average value of the taxpayer’s real and tangible per-

outside the subzone, expansion subzone or

sonal property owned and used in the subzone,

SDA, but the service performed outside the

expansion subzone or SDA plus eight times the rental

subzone, expansion subzone or SDA is incidental

rate for real and tangible personal property rented

to the person's service within the subzone,

and used in the subzone, expansion subzone or SDA.

expansion subzone or SDA; or

Within PA — The average value of taxpayer’s real

(C) Some of the service is performed in the subzone,

and tangible personal property owned and used

expansion subzone or SDA and the base of

in PA plus eight times the rental rate for real and

operations is in the subzone, expansion subzone

tangible personal property rented and used in PA. If

or SDA. If there is no base of operations,

the taxpayer uses three-factor apportionment in

compensation is paid in the subzone, expansion

calculating its capital stock/foreign franchise tax or

subzone or SDA if the place from which the

corporate net income tax, this amount will be the

service is directed or controlled is in the subzone,

property reported inside PA on Table 1 of the Tables

Supporting Determination of Apportionment

expansion subzone or SDA. If the place from

Percentage, form RCT-106.

which the service is directed or controlled is not

in a location in which the employee’s work is

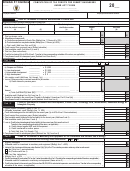

Payroll Apportionment Factor

performed, compensation is paid in the subzone,

Within Subzone, Expansion Subzone or SDA — Total

expansion subzone or SDA if the employee’s

compensation paid in the subzone, expansion

residence is within the subzone, expansion

subzone or SDA. Compensation is paid in the

subzone, expansion subzone or SDA if:

subzone or SDA.

NEXT PAGE

PRINT FORM

1

1 2

2 3

3 4

4