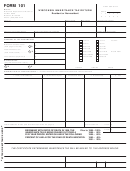

Form 101 - Wisconsin Inheritance Tax Return Page 2

ADVERTISEMENT

Page 2

SUMMARY OF ASSETS AND DEDUCTIONS

Enter the totals from the attached Wisconsin schedules or the totals from the attached federal estate tax return adjusted to the amounts

reportable for Wisconsin inheritance tax purposes. Use the date of death value in determining the value of property to be entered below.

PROBATE ASSETS

1. Real Estate - Schedule A

$

2. Stocks and Bonds - Schedule B

3. Mortgages, Notes & Cash - Schedule C

4. Insurance Payable to Estate - Schedule D, section a

5. Other Miscellaneous Property - Schedule F

$

6. Total Probate Assets - Add Lines 1 Through 5

DEDUCTIONS

$

7. Funeral Expenses - Schedule J, section a

8. Administration Expenses - Schedule J, section b

9. Debts of Decedent - Schedule K, section a

10. Mortgages & Liens - Scheduke K, section b

11. Federal Estate Tax Paid

$

12. Total - Add Lines 7 Through 11

$

13. Net Probate Estate - Subtract Line 12 From Line 6

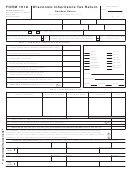

OTHER ASSETS

14. Jointly Owned —

$

A. Schedule E1 - Line 6

Survivorship

Marital Property

B. Schedule E2 - Line 6

$

15. Total - Add Lines 14A and 14B

(

)

16. Cost of Terminating Joint Tenancy - Schedule J, section c

$

17. Net Joint Property - Subtract Line 16 From Line 15

18. Insurance Payable to Named Beneficiairies - Schedule D, section b

19. Transfers During Decedent’s Life - Schedule G

20. Powers of Appointment - Schedule H

21. Annuities & Employe Death Benefits - Schedule I, section b

$

22. Subtotal of Other Assets - Add Lines 17 Through 21

23. Wisconsin Taxable Estate (Add lines 13 and 22) -

$

Enter here and on page 1 under Summary of Tax Information

Note:

Where any line is left blank and the appropriate schedule for that line is not filed with this return, it will be deemed that NONE is

the DECLARATION for that line by the person(s) signing this return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4