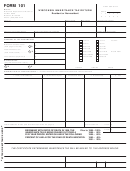

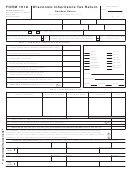

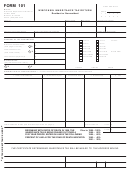

Form 101 - Wisconsin Inheritance Tax Return Page 4

ADVERTISEMENT

GENERAL INSTRUCTIONS

TRANSFERS SUBJECT TO THE INHERITANCE TAX. The Wisconsin inheri-

Detail each beneficiary’s distributive share and tax on the Distribution Schedule

tance tax is imposed upon any transfer of property to any distributee when:

on page 1. List names and dates of birth of all life tenants who share in the

distributive estate in the section above the declaration on page 3.

a. the transfer is from a person who dies while a resident of this state, or

b. the transfer is of property within the jurisdiction of this state and the

Signature and verification. The person who files the return must, in every

decedent was not a resident of this state at the time of death.

case, verify and sign the return. The filer is responsible for the return as

filed and is subject to any liability or penalty provided for filing an erroneous,

Property means any interest, legal or equitable, present or future, in real

false, or fraudulent return. If the return is prepared by an attorney or agent

or personal property, or income therefrom, in possession and enjoyment,

for the filer, the return must also be signed by the preparer.

trust or otherwise within or without this state.

VALUATION. All property included for Wisconsin inheritance tax purposes

Distributee means any person to whom property is transferred by reason of

must be valued at its fair market value as of the date of the decedent’s death.

a death or in contemplation of death other than in payment of a claim.

All property which does not have a readily ascertainable value must be ap-

praised. However, where a homestead consists of a single-family dwelling

or a duplex, the equalized assessed valuation may be used. Any interested

TRANSFERS EXEMPT FROM THE INHERITANCE TAX:

party, including the department, may request an appraisal.

1. Resident decedent when the transfer is of real estate or tangible personal

Determination of the value of every future or limited estate, income interest

property located outside of this state. The tangible personal property must

or annuity dependent upon any life or lives in being shall be based on tables

be permanently outside Wisconsin not merely outside for safekeeping.

used by the Internal Revenue Service for like computations.

2. Nonresident decedent when the transfer is of intangible personal property

and the decedent was not a resident of a foreign country.

INHERITANCE TAX CERTIFICATES. Upon determination of the value of

the property and the tax, the Wisconsin Department of Revenue will issue

WHO MAY USE THIS RETURN. This form may be used for all deaths on

a dated certificate showing the amount of tax and interest, if any.

or after July 1, 1982. If death is prior to July 1, 1982, refer to Chapter 72 of

the statutes for differences in the various schedules, exemptions and rates.

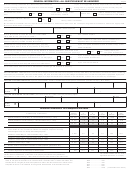

SUPPLEMENTAL DOCUMENTS. Refer to the following list as an aid in

This form may not used for deaths prior to May 14, 1972.

determining what supplemental documents should be submitted with the

return. Failure to file copies of these documents may delay the issuance of

Who may file this return. Only one Wisconsin inheritance tax return should

the inheritance tax certificate.

be filed for each decedent. The personal representative has the primary

responsibility for the return. If there will be no personal representative,

1. Will and any codicils.

the responsibility for the return shall be assumed in the following priority:

special administrator, trustee, distributee, or other person interested. The

2. Federal estate tax return when a federal estate tax return is filed.

person filing the return must report all transfers of property subject to the

inheritance tax.

3. Federal closing letter and proof of federal tax paid if available.

Time for filing a return. An inheritance tax return may be filed at any time

4. Trust instruments for any trust in which the decedent at time of death

after death. However, see instructions for TAX, INTEREST & PAYMENT.

had any interest, power, or control. See Wisconsin Schedules F, G, and

H for additional instructions.

Where return is filed. The return must be filed with the Wisconsin Department

5. Documents granting power of appointment or disposition including copies

of Revenue, Post Office Box 8906, Madison, Wisconsin 53708.

of any documents exercising or releasing any power. See s. 72.78 (1) (e).

TAX, INTEREST & PAYMENT

6. Apportionment schedule: Whenever the decedent owned property not

subject to the jurisdiction of this state, deductions and personal exemp-

All checks should be made payable to the Wisconsin Department of

tions must be apportioned. Attach an apportionment schedule to Form

Revenue. All taxes and interest due must be remitted when the inheritance

101. See Schedule J instructions.

tax return is filed. Anyone personally liable for the tax may pay an estimated

tax before the correct liability is determined. All advance payments must be

7. Partnership Agreements if the decedent owned an interest as a partner

accompanied by Form 401T, Report of Inheritance Tax Payment, completed

in any business or venture. Include an equity statement based on the

in duplicate. If a prepayment was made, any additional tax shown owing

partnership records and indicate adjustments made to arrive at appraised

on the return as filed must be submitted with the return at the time of filing

values.

unless payment by installment is elected. If the advance payments exceed

the tax as finally determined, the excess will be refunded. Include as an

8. Financial Documents such as balance sheets, statements of net earn-

advance payment on the inheritance tax return any Wisconsin gift taxes

ings, etc. which relate to any equity in partnerships, sole proprietorships

paid on property included in the decedent’s estate. See s. 72.87 (1). If the

and closely held corporations. See instructions for Schedules B and F.

inheritance tax is not paid within one year of the decedent’s date of death,

interest is due. Interest is calculated from the date of death to the date the

9. Restrictive Agreements such as buy-sell agreements or other contracts

tax is paid at the rate of 12% per year.

which provide for the sale or transfer of any property of a decedent at

death together with any computations and supporting data used to arrive

Installment payments. If a major portion of the decedent’s estate is an

at the transfer price.

interest in a farm or other closely held business, the distributees receiving

a portion of that business may elect to qualify their inheritance tax in install-

10. Affidavit of a surviving joint tenant who claims contribution towards

ments. This election must be filed with the department within one year of

the acquisition of joint property reported on Schedule E2.

the date of death. Contact the Wisconsin Department of Revenue for further

information regarding installment payments.

11. Affidavit when a mutually acknowledged child/parent relationship

is claimed. The affidavit should include all information as to why the

WISCONSIN ESTATE TAX. There may be a Wisconsin estate tax imposed

on Wisconsin resident estates when the state death tax credit allowable on

child/parent has a mutually acknowledged relationship under s. 72.01

the federal estate tax return exceeds the inheritance tax. See s. 72.61.

(15), or (15m).

PREPARATION OF THE RETURN. The basic return consists of three pages

12. Inheritance Tax Credit. Pursuant to s. 72.20 a tax credit may be al-

and is supported by Wisconsin Schedules A through K and MP. If a federal

lowed based on the tax paid by this decedent on the transfer of property

estate tax return is filed, attach a complete copy of it. When federal schedules

acquired from this decedent’s predeceased spouse. See Wis. Schedule

are not required or when assets or deductions differ from the corresponding

R for additional information.

federal schedules, attach the appropriate Wisconsin Schedules A through

K. If an inheritance tax credit is claimed, attach Wisconsin Schedule R. If

13. Marital Property Documents. See Wis. Schedule MP.

there is marital property, attach Schedule MP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4