Form 101 - Wisconsin Inheritance Tax Return Page 3

ADVERTISEMENT

GENERAL INFORMATION – ALL QUESTIONS MUST BE ANSWERED

Page 3

Will the Closing Certificate for Fiduciaries (also called the

If yes, it is suggested that the request for this certificate

“income closing certificate”) be needed to close this estate

along with any required fiduciary returns accompany the

Yes

No

with the Circuit Court?

inheritance tax return when it is filed.

If yes, attach a copy of the

if there has been any previous

Did decedent have a

Yes

No

Check box

will and any codicils.

correspondence on this estate

will?

If yes, attach a complete copy of the federal return, proof of payment, and

Is a Federal Estate Tax Return

Yes

No

closing letter, if available.

being filed?

When federal schedules are not required or when assets or deductions differ from the corresponding federal schedules, attach the appropriate

Wisconsin Schedules A through K.

Occupation while employed

State of residence at death

Year residence established

Employer

If no, please explain

Was a Wisconsin income tax return or Homestead

Yes

No

claim filed for the year prior to death?

If yes, indicate its value and attach a schedule for

Did decedent own any real estate or tangible

Yes

No

apportionment of deductions and exemptions.

personal property located outside Wisconsin?

Did decedent during lifetime give away any property

If yes, complete Schedule G and include a copy of the

Yes

No

valued at $10,000 or more to any person in any year?

death certificate.

Did decedent transfer any property during lifetime, in trust or otherwise, and retain a life

If any part is yes,

Yes

No

use or any income or economic benefit from it or any powers or control over the property?

complete Schedule G.

Did the decedent possess any general power of

If yes, attach a copy of the document granting the power

Yes

No

appointment or other power as defined in s. 72.28(1)(e)?

and complete Schedule H.

Within one year of death did the decedent acquire any

Yes

No

If yes, submit full details.

property for less than adequate and full consideration?

Enter names and dates of birth of distributees receiving a life interest in property.

DECLARATION:

I declare that I have made a diligent and careful search for property of every kind left by the decedent, and that this return, including

accompanying schedules, has been examined by me, and is to the best of my knowledge and belief, true, correct and complete. If prepared by anyone

other than the person filing this return, the preparer’s separate declaration is based on all information of which he or she has any knowledge.

PERSONAL REPRESENTATIVE, special administrator, trustee, distributee or other person interested. (Section 72.30(1), Wis. Stats.)

Name

Designation

Zip code

Address

Telephone number

Date

SIGN

}

HERE

(

)

PERSON PREPARING THE RETURN (individual and firm) if other than the preceding signer

Name

Designation

Zip code

Address

Date

Telephone number

SIGN

}

HERE

(

)

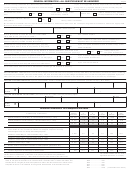

Wisconsin Inheritance Tax Exemptions and Rates**

Balance

$25,000

$50,000

$100,000

Personal

Over

Relationship of Decedent

of

to

to

to

Exemptions

$25,000

$50,000

$100,000

$500,000

$500,000

A

Spouse (deaths on or after May 14, 1972 and before January 1, 1974)

1

$50,000

2.5%

5.0%

7.5%

10.0%

12.5%

Spouse (deaths on or after January 1, 1974 and before July 1, 1979)

50,000

1.25

2.5

3.75

5.0

6.25

Spouse (deaths on or after July 1, 1979 and before July 1, 1982)

250,000

1.25

2.5

3.75

5.0

6.25

Spouse (deaths on or after July 1, 1982) All property received is exempt

A

Lineal issue (children, grandchildren), lineal ancestor (parents, grandparents),

2

wife or widow of a son, husband or widower of a daughter, adopted or mutually

acknowledged child, or mutually acknowledged parent.

4,000

2.5

5.0

7.5

10.0

12.5

Deaths on or after May 14, 1972 and before July 1, 1979

10,000

2.5

5.0

7.5

10.0

12.5

Deaths on or after July 1, 1979 and before April 13, 1984

25,000

2.5

5.0

7.5

10.0

12.5

Deaths on or after April 13, 1984 and before July 1, 1985

50,000

2.5

5.0

7.5

10.0

12.5

Deaths on or after July 1, 1985

1,000

5.0

10.0

15.0

20.0

25.0*

B

Brother, sister, or descendant of brother or sister (nephew, grandniece, etc.)

1,000

7.5

15.0

22.5*

30.0*

30.0*

C

Brother or sister of a father or mother, or a descendant of such brother or sister

500

10.0

20.0

30.0*

30.0*

30.0*

D

All others regardless of relationship to the decedent

The personal exemption is applied against the lowest bracket.

The shaded brackets are only used in

The tax shall not exceed 20% of the value of the property transferred to any distributee.

apportionment cases - s. 72.14(3).

*For deaths on or after January 1, 1986, these tax rates are 20% instead of the rates shown.

Year of Death

Reduce Tax By

** The inheritance tax is being phased out over a 5-year period starting with deaths occurring in

1988 ......................... 20%

1988. To compute the inheritance tax owed because a decedent dies in 1988 or thereafter, first

1989 ......................... 40%

calculate the tax using the personal exemptions and rates in the above table. Then reduce the tax

1990 ......................... 60%

computed as shown in the schedule to the right and the difference is the inheritance tax due.

1991 ......................... 80%

1992 ........................ 100%

(no inheritance tax is due)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4