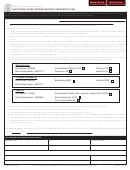

SECTION 4: TRADING PARTNER AGREEEMENT FORM 4572

INSTRUCTIONS

The Trading Partner Agreement (TPA), Form 4572, is included in this publication.

This form is used to provide contact information to the department and implies intent to

submit payments electronically through banking or third party software. This agreement

can be submitted directly by the paying entity or by a payroll or tax preparer. The

contact information must be supplied, and applies to the person directly responsible for

submitting tax payments. A Power of Attorney section is provided if the contact, payroll

representative, or tax preparer wishes to have authorization to discuss returns and

payments regarding an enrolled client or taxpayer. If a payroll service or tax preparer

submits payments for many clients or taxpayers, a single TPA can be submitted along

with a separate list of all clients to be enrolled. The TPA does not automatically qualify a

client for electronic submission of payments. All entities must still be approved for

submission through the pre-notification process (See Section 5, ACH Records and Pre-

Notification Testing).

Completed TPAs must be faxed to (573) 526-5915. If any contact information

changes after completion of TPA please notify the department’s E-File Unit.

SECTION 5: ACH RECORDS and PRE-NOTIFICATION

TESTING

This publication lists all the records and necessary information to submit an ACH

transaction through a financial institution or software package. In many cases these

entities have already formatted these records and require only minimal input from the

customer, such as bank account number, routing number, tax information, etc. A table

of banking and tax Information is included in this document as a reference. Contact your

financial institution or software provider to determine what information is required to

format and submit payments.

It is standard business practice for originators to submit a pre-notification test

(Pre-Note) to the receiving entity. The Pre-Note is a zero dollar transaction, which tests

to ensure that the originator is transmitting to the proper bank account and routing

number. Upon receipt of the Pre-Note the department will notify the appropriate contact

with test results. If a Pre-Note is received with incorrect formatting information it may

need to be re-submitted. If a Pre-Note is sent and no notification is received from the

department within five (5) working days, please contact the E-File Unit (See Page 4).

Some entities submit tests by sending either one cent or one dollar. These are

considered live production payments by the department; therefore, the originator will

need to contact the E-File Unit for the status of this type of test.

Upon successful Pre-Note testing, entities may begin submitting payments.

Entities having an established history of successful payments do not need to submit Pre-

Notes for new clients.

5

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16