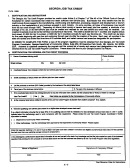

Schedule A

List of Qualifying Full-time Employees

(Form 304)

• Complete this schedule for each year (1-6) that Form 304 is filed.

• Attach a list of all full-time and full-time equivalent employees used to qualify for this credit.

• List must be in the format shown in the sample below.

• No more than two part-time employees can be used as the equivalent of one full-time employee.

Two or more affiliated companies may elect to aggregate the number of jobs created for qualified full-time employees as the

result of the establishment or expansion by the individual companies to qualify for this credit. "Affiliated companies" means

two or more companies related to each other such that one company owns at least 80% of the voting power of the other

(or others) or at least 80% of the voting power of two or more companies is owned by the same interests. For each month,

enter the total number of qualifying full-time or equivalent full-time employees on Schedule B.

Each qualifying full-time position must:

(a) be of indefinite duration, created by the taxpayer as a result of the establishment or expansion of a major business facility

in Virginia; and

(b) require a minimum of 35 hours per week for the entire year (minimum of 48 weeks); or

(c) require a minimum of 35 hours a week for the portion of the taxable year in which the employee was initially hired for, or

transferred to, the facility in Virginia.

Note that the hours of two qualifying part-time employees may be combined to qualify as one "equivalent" full-time employee.

Seasonal or temporary positions and jobs created when a job function is shifted from an existing location in Virginia to the

new major business facility and positions in building and grounds maintenance, security and other such positions which are

ancillary to the principal activities performed by the employees at a major business facility do not qualify.

"Qualified full-time employees" may include the employees of a contractor or a subcontractor if they are permanently

assigned to the taxpayer's major business facility. The taxpayer must be able to provide evidence to the Virginia Department

of Taxation of a contractual agreement with the contractor or subcontractor prohibiting the contractor or subcontractor from

also claiming these employees in order to receive a credit under this section.

In addition to including your name as it appears on the Form 304, your FEIN or Social Security Number, and the location of

your major business facility or date of expansion, your list must include the following columns:

Columns A and B: Enter the name and Social Security Number of each qualifying employee. If claiming a qualifying

employee of a contractor or affiliated company (see the above paragraph), make a notation beside

each such employee in Column A and attach a separate schedule showing the corresponding affiliated

company or contractor.

Column C:

Enter the number of full months that the employee was employed in a qualifying position during the

credit year.

Column D:

Enter a brief position description for the qualifying employee.

Column E:

Part-time employee hours per week. * Enter the number of hours worked per week by the qualifying

part-time employee. No more than two qualifying part-time employees may be combined to qualify

as an "equivalent" full-time employee.

Column A

Column B

Column C

Column D

Column E

Employee Name

Social Security Number

Number of Full

Brief Position Description/Number

Part-time

(Use Additional Schedules as

Months Employed

Employee*

Necessary)

During the Credit

(Number of Hours

Year

Per Week)

1

2

3

4

5

6

7

Attach to Form 304, Major Business Facility Job Tax Credit

Page 2

1

1 2

2 3

3 4

4 5

5 6

6