Instructions for Completing Form 304, Major Business Facility Job Tax Credit

Qualifying for the Credit

a certification letter confirming your credit amount.

Where to File Form 304

Individuals, estates, trusts, corporations, banks, insurance

companies and telecommunications companies may claim

Send your completed Form 304 to: Tax Credit Unit;

Major Business Facility Job Tax Credits if the taxpayer

Virginia Department of Taxation; P.O. Box 715;

creates new full‑time jobs in excess of the threshold amounts

Richmond, Virginia 23219.

established for one of the two credit tiers. This credit is not

Please Note:

available to retail businesses if retail trade is the principal

activity of the facility. The taxpayer cannot claim both the

•

Form 304 must be filed for a total of six taxable years

Major Business Facility Job Tax Credit and the Coalfield

following each expansion.

Employment Enhancement Tax Credit, the Clean Fuel

•

A separate Form 304 must be filed for each major

Vehicle and Advanced Cellulosic Biofuels Job Credit, the

business facility or qualified job expansion.

Green Job Creation Tax Credit or the International Trade

Facility Tax Credit.

•

Do NOT attach Form 304 to your tax return.

Where to Get Help

A qualified business firm receiving an Enterprise Zone

Job Creation Grant under Va. Code § 59.1‑547 shall not

Write to the Virginia Department of Taxation, P. O.

be eligible to receive a Major Business Facility Job Tax

Box 715, Richmond, VA 23218-0715 or call (804)

Credit for any job used to qualify for the Enterprise Zone

786-2992.

Job Creation Grant.

Forms and instructions are available for download from the

The thresholds for the two credit tiers are as follows:

Department's website or by calling

(804) 440‑2541.

Tier 1: The qualifying threshold amount for Tier 1 is 100

new jobs for the establishment or expansion of a major

Forms are also available from the office of your local

business facility in Virginia. Please note that for taxpayers

Commissioner of the Revenue, Director of Finance or

whose expansion year begins on or after January 1, 2010

Director of Tax Administration.

the threshold has been reduced to 50 new jobs.

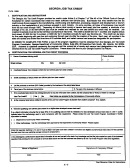

Form Instructions

Tier 2: The qualifying threshold amount for Tier 2 is 50 new

• Lines not specifically mentioned below are self‑explanatory.

jobs for the establishment or expansion of a major business

facility in a locality identified by the Virginia Economic

• Fiscal year filers: Using your federal tax period, complete

the line at the top of the form.

Development Partnership as an economically distressed

area or has been designated as an Enterprise Zone. Please

• Name, Account Number and Federal Employer

note that for taxpayers whose expansion year begins on or

Identification Number or Social Security Number:

after January 1, 2010 the threshold has been reduced to 25

Enter the information requested.

new jobs.

Lines 1a through 2e: Provide information for the credit year.

Taxpayers can qualify for and claim a credit for only one tier

Line 3: Number of qualifying employees: Complete

per facility. Credits are subject to recapture if employment

Lines 3a and/or 3b as explained on the form. You may use

decreases during the five years following the credit year.

substitute Schedules A and B if they contain the same data.

Computing and Claiming the Credit; Due Date for

Line 3a: If this is the credit year (the first taxable year

Form 304

following the taxable year in which the major business

• A company cannot file Form 304 and claim this credit

facility was established or expanded), complete Schedules

until the first taxable year following the taxable year in

A and B, and enter the amount from Schedule B, Line N.

which the company becomes eligible for the credit by

Line 3b: Enter the average number of qualified full‑time

establishing or expanding a major business facility in

employees reported on the quarterly employment tax

Virginia.

reports made to the Virginia Employment Commission

• A company may enter into a new major business

for the current year. The average number of qualified

expansion at the end of each credit year. Each expansion

employees must be calculated to two decimal places.

year must begin on the same date. For example: if your

Line 3c through 3e: Provide the information requested. If

credit year ends on 12/31/10 and your expansion year

you have questions, call 804‑786‑2992.

began on 02/01/08, you can begin a new expansion on

02/01/11.

Line 6: Multiply amount on Line 5 by $1,000.

• Complete Form 304 to compute your credit and forward it

Line 7: For the credit year and the subsequent taxable year,

to the Tax Credit Unit at the address below at least 90 days

1

enter

/

of the amount on Line 6. However, you may enter

3

prior to the due date of your tax return. You will receive

1

/

of the credit amount on Line 6 if your credit year's

2

Page 5

1

1 2

2 3

3 4

4 5

5 6

6