Clear This Page

Section 3. General financial information—personal and business (continued)

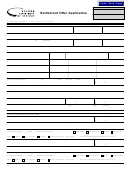

Other financial information. If you check “Yes,” provide dates, an explanation, and documentation. Attach additional pages as needed.

Court proceedings (litigation, probate, etc) .......

No

Yes _______________________________________________________________________________

Anticipated increase in income .........................

No

Yes _______________________________________________________________________________

Bankruptcies/receiverships ...............................

No

Yes _______________________________________________________________________________

Transfer assets in last 12 months ......................

No

Yes _______________________________________________________________________________

Beneficiary to trust, estate, profit sharing, etc. .

No

Yes _______________________________________________________________________________

Transferred property. Vehicles, equipment, or property sold, given away, donated, or repossessed in the last 3 years. Attach additional pages as needed.

Year, make, model of vehicle or equipment, or property address

Who took possession

Value

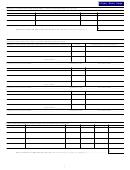

Section 4. Asset and debt analysis (values can’t be less than -0-)

Amount

Immediate assets. For lines 2-7, enter totals from Section 3.

1. Cash on hand

2. Bank accounts—total balance

3. Automobiles—total equity

4. Personal property—total equity

5. Life insurance—total loan/cash surrender value

6. Securities—total value

7. Safe deposit box contents—total value

8. Promissory notes owed to you

9. Business accounts receivable

10. Judgments/settlements receivable (legal action which may result in a payoff to you)

11. Interest in trusts

12. Interest in estates

13. Interest in partnership(s)

14. Business capital assets (major machinery or equipment used in your business, etc)

15. Business inventory (supplies, finished products on hand, etc)

16. Other personal property (collectibles, guns, jewelry, tools, antiques, coins, gold, silver, etc.)

17. Other asset (explain; don’t include everyday household items):

18. Other asset (explain; don’t include everyday household items):

$

19. Total value of all immediate assets

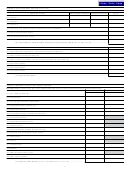

.....................................................................................................................

10

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16