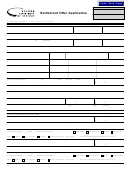

General information

Introduction

What to include in your settlement offer

It must include:

Some taxpayers owe more tax than they can pay. If

you’re in this situation, we may be able to help you

• The completed and signed application. If your offer

settle your tax debt by paying less than you owe. This

isn’t signed, we’ll return it without processing. You

is called a settlement offer.

may resend the signed offer.

The settlement offer process isn’t easy and it won’t

• All supporting documentation (see page 6).

work for everyone; however, it may be worth applying

• The Tax Information Authorization and Power of Attorney

for if you can prove you don’t have enough money to

for Representation form if you want someone to repre-

it pay off.

sent you during the settlement offer (page 15).

• A nonrefundable payment that is 5 percent of the

Conditions for qualifying

settlement offer amount. Payment must be money

To qualify for a settlement offer, you must meet all of

order, cashier’s check, or cash.

these conditions:

If you don’t include payment, we’ll return your offer

• You’re not appealing any tax debts.

without processing it. You may resend the applica-

tion with your payment.

• You must have filed all required Oregon tax returns

for all tax years and all tax types.

What to expect after you submit your application

• You haven’t completed another settlement offer since

• If your application is complete, we’ll review it and

October 1, 2001.

usually accept or deny it within 30 days. We’ll notify

• You must show that you cannot sell assets or borrow

you in writing of our decision.

against them to pay your tax debt.

If your application is incomplete or inaccurate, we

• You must show that you don’t have enough monthly

may send it back to you or ask you to send us more

information. This will delay our review.

income or assets to pay your tax debt in full.

• We’ll continue collection action on your debt while

• You’re not in bankruptcy or in litigation.

we review your application. Such action may include

garnishing your wages, placing property liens, and

Before you start

seizing property.

It will take you at least three hours to complete the

application. You must locate and copy many documents

Settlement offer acceptance

(bank statements, pay stubs, lease agreements, deeds,

• If we accept your settlement offer, you must pay the

etc) to include with your application (see page 6).

amount in full within 10 days.

Not everyone who applies for a settlement offer will

• If you can’t pay the entire amount at one time, you

qualify. To determine your chances, ask yourself these

may ask for a payment plan to pay it off in six equal

questions:

monthly payments.

1. Do you receive Social Security income, Social

• We’ll accept credit or debit card, check, money order,

Security disability, pension payments, or public

cashier’s check, or cash.

assistance?

• You can never have another settlement offer.

2. Are you over age 60?

Settlement offer denial

3. Are your total assets worth more than $5,000?

If we deny your settlement offer:

4. Is your only asset your home?

• You can’t appeal our decision.

5. Is your tax debt older than seven years?

• We’ll apply your 5-percent payment to your tax debt.

If you answered yes to two or more questions, call

503-945-8824 for more information. Otherwise, con-

• You may file another application with a 5-percent

payment.

tinue filling out the settlement offer application.

2

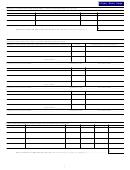

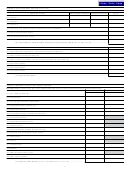

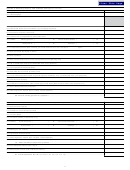

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16