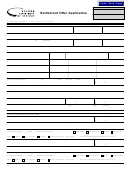

Clear This Page

Department use only

Date received

Settlement Offer Application

Revenue agent

• Complete all sections. • Don’t fill in shaded boxes.

Section 1. Personal information

Your first name

MI

Last name

Your Social Security number

Your date of birth

–

–

Other names or aliases used

Spouse/RDP first name

MI

Last name

Spouse/RDP Social Security number

Spouse/RDP date of birth

–

–

Spouse/RDP other names or aliases used

Your driver’s license number

State

Spouse/RDP driver’s license number

State

Social Security number

Relationship

Dependent name (living with you)

Date of birth

–

–

Dependent name (living with you)

Social Security number

Date of birth

Relationship

–

–

Social Security number

Relationship

Dependent name (living with you)

Date of birth

–

–

Phone number

Your current street address

City

State

ZIP code

County

(

)

Your mailing address (if different from above)

City

State

ZIP code

E-mail address

Name of your tax representative (CPA, attorney, etc)

Fax number

Phone number

(

)

(

)

Tax representative’s address

City

State

ZIP code

Section 2. Employment information

Name of employer or business (if self-employed)

Phone number

(

)

Address

City

State

ZIP code

How long employed:_____

_____

Occupation: __________________

Wage earner

Sole proprietor

Partner

Owner/officer

Year(s)

Month(s)

Paid:

Weekly

Every 2 weeks

Monthly

Twice monthly (e.g., 1st & 15th)

Number of allowances claimed on Form W-4:________

Phone number

Name of spouse/RDP employer or business (if self-employed)

(

)

City

State

ZIP code

Address

How long employed:_____

_____

Occupation: __________________

Wage earner

Sole proprietor

Partner

Owner/officer

Year(s)

Month(s)

Paid:

Weekly

Every 2 weeks

Monthly

Twice monthly (e.g., 1st & 15th)

Number of allowances claimed on Form W-4:________

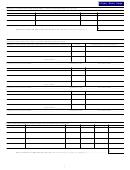

7

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16