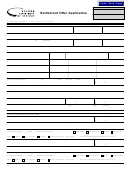

Line 87, 5-percent nonrefundable payment to submit

Section 7. Additional information

with your application (whole dollar amount only).

You may include information that you want us to know

Example: Anne adds her disposable income formula

regarding your settlement offer.

amount of $54,000 (line 83) to her assets and equity

formula amount of $2,250 (line 85).

Terms and conditions

$54,000 + $2,250 = $56,250.

Read the terms and conditions carefully before you

sign the taxpayer agreement.

She enters $56,250 on line 86 and multiplies it by

0.05

Taxpayer agreement and authorization to use

$56,250 x 0.05 = $2,812.50

credit reports

She enters $2,812.50 on line 87.

By signing, you confirm that the information in your

application is correct and complete to the best of your

Anne gets a cashier’s check for $2,813, fills out the

knowledge.

payment coupon (page 6), and includes both with

her application.

Your signature also authorizes us to use credit reports

and other tools to verify any information in your appli-

Payoff information—You must pay the offer amount in

cations, and for collection purposes.

full within 10 days from the date of our acceptance letter.

Before mailing

If you can’t pay it all at once, you may pay it off in six

equal monthly payments. Write the day of the month

Review your application to make sure it’s complete and

you want your installment payment to be due.

includes all supporting documentation, your payment,

and the payment coupon.

Tax debts included in settlement offer—Write the tax type

and years/quarters of taxes.

Have questions? Need help?

Internet

Phone

Settlement offers ......................................... 503-945-8824

• Download forms, instructions, and publications.

Salem area or outside Oregon .................... 503-378-4988

• Check your refund status.

Toll-free from an Oregon prefix ............... 1-800-356-4222

• Make payments.

• Check your refund status.

• Find out how much you owe.

• Order forms, instructions, and publications.

Twitter: ORrevenue

• Listen to recorded information.

• Speak with a representative:

E-mail or write

Monday–Friday ...................................... 7:30 a.m.– 5 p.m.

Closed Thursdays from 9–11 a.m. Closed holidays. Extended

General: questions.dor@state.or.us

hours during tax season; wait times may vary.

Settlement offers: settlement@dor.state.or.us

Asistencia en español:

Oregon Department of Revenue

En Salem o fuera de Oregon ...................... 503-378-4988

955 Center St NE

Gratis de prefi jo de Oregon ..................... 1-800-356-4222

Salem OR 97301-2555

TTY (hearing or speech impaired; machine only):

• Include your name and daytime phone number.

Salem area or outside Oregon ................... 503-945-8617

• Include the last four digits of your SSN or ITIN.

Toll-free from an Oregon prefi x .............. 1-800-886-7204

Printed forms or publications:

Americans with Disabilities Act (ADA): Call one of the help

Forms

numbers above for information in alternative formats.

Oregon Department of Revenue

PO Box 14999

In person

Salem OR 97309-0990

Español: preguntas.dor@state.or.us

Find directions and hours on our website.

5

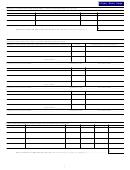

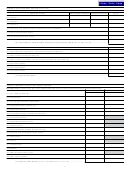

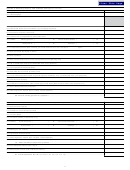

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16