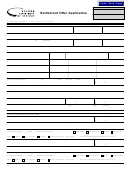

Clear This Page

Section 5. Monthly income and expense analysis (continued)

Monthly personal expenses (actually paid).

Amount

52

. Rent/mortgage

If renting, landlord’s name, address, phone number

53. Real estate taxes (if not included in your mortgage payment)

54. Homeowner’s/renter’s insurance

55. Homeowner or neighborhood association fees

+

=

56. Utilities:

Electric/gas/oil: (

)

Phone/internet/cable: (

)

+

=

Water/sewer: (

)

Garbage: (

)

57. Household expenses (food, clothing, personal products, etc) No. of people:

Ages:

58. Auto payments (purchase or lease)

59. Auto insurance

60. Auto maintenance, fuel, or other transportation costs (parking, etc)

61. Life or health insurance (if not deducted from your paycheck)

62. Out-of-pocket medical expenses

63. Estimated tax payments (provide proof)

64. Court-ordered payments (alimony, child support, restitution, etc., not deducted from your paycheck)

65. Garnishments (wages)

66. Delinquent tax payments, other than Oregon state taxes (federal, other state, local, property, etc)

67. Work-related child care expenses

68. Other expenses: explain (don’t include unsecured debt)

$

69. Total monthly personal expenses ...................................................................................................

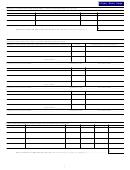

Amount

Monthly business expenses (actually paid). Provide current general ledger and profit/loss statement.

70. Materials and supplies

71. Installment and monthly payments

72. Rent/mortgage

73. Insurance (liability, malpractice, etc)

+

=

74. Utilities:

Electric/gas/oil: (

)

Phone/internet/cable:

(

)

+

=

Water/sewer: (

)

Garbage:

(

)

75. Net wages and salaries

76. Payroll and business taxes

77. Other expenses: explain (don’t include unsecured debt)

78. Total monthly business expenses ...................................................................................................

$

79. Enter net dollar amount from line 51

80. Add lines 69 and 78; enter total dollar amount

81. Net disposable income (subtract line 80 from line 79) ..................................................................... $

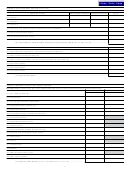

12

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16