Form 150-102-042 - Ach Credit Electronic Funds Transfer Program Guide Page 10

ADVERTISEMENT

Clear Form

Department of Revenue Use Only

Date Received

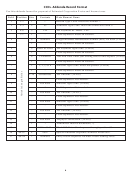

ACH CREDIT AGREEMENT AND APPLICATION

FOR ESTIMATED CORPORATION EXCISE AND INCOME TAX

Excise

Income

• Please type or print clearly in black ink.

• Check the correct box (above) to indicate whether you are subject to excise or income tax.

• Check the correct box to indicate whether this is a new application or a change.

• Return your completed application to the address or fax number listed below.

New

Change

Business Name

Oregon Business Identification Number (BIN)

Address

Federal Employer Identification Number (FEIN)

City

State

ZIP Code

EFT Contact Person

Telephone Number

(

)

E-mail Address

Fax Number

(

)

I (we) contacted my (our) financial institution and confirmed that the financial institution can initiate

Automated Clearing House transactions that meet Oregon Department of Revenue requirements. For

verification, the department may contact:

Name of Financial Institution

Financial Institution Contact Person

Telephone Number

(

)

Check this box if these transactions will be funded from a non-US financial institution.

I (we) request that the Department of Revenue grant authority to the above named business to initiate Automated

Clearing House credit transactions to the bank account of the State of Oregon. I (we) understand transactions

must be in the National Automated Clearing House Association (NACHA) CCD+ format using the Tax Payment

(TXP) Banking Convention and may only be initiated for payment of Oregon Estimated Corporation Excise or

Income Taxes. I (we) understand that the above named business is responsible for paying the cost of initiating such

transactions that may be charged by the business’ financial institution. I (we) acknowledge that the origination of

ACH transactions to my (our) account must comply with the provisions of state and U.S. law. I (we) and the Oregon

Department of Revenue agree to abide by all applicable ACH operating rules in effect from time to time.

This agreement is to remain in full force and effect until the Oregon Department of Revenue has received written

notification from me (or either of us) of its termination so as to afford the interested parties a reasonable time to act

on it.

Authorized Signature

Title

Date

X

150-102-042-1 (Rev. 11-09)

Send your completed agreement to: EFT Coordinator

Administrative Services Division

Oregon Department of Revenue

PO Box 14725

Salem OR 97309-5018

Or fax it to: 503-947-2016

KEEP A COPY OF THIS AGREEMENT FOR YOUR RECORDS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11