Form 150-102-042 - Ach Credit Electronic Funds Transfer Program Guide Page 4

ADVERTISEMENT

contact your financial institution to determine what

(referred to as a pre-note), processed at least 10 days

ACH origination services they offer as well as the

before the initiation of your first EFT payment. For

cost before selecting the ACH credit method.

questions about sending a zero-dollar test transac-

tion, call our EFT Help/Message Line, 503-947-2017.

Note: Oregon does not accept same day FedWire

transactions.

Note: If you do not owe estimated corporation tax

on a payment date, you don’t need to send a trans-

In order to report your tax payment correctly while

action through the ACH network. ACH is only for

using the ACH credit method, your financial in-

tax amounts due.

stitution must originate your payment using the

“Cash Concentration or Disbursement plus Tax

Penalty and interest

Payment Addendum” (CCD+TXP) format. This

format is a standard format that has been adopted

What happens if I don’t make my EFT payments by the

for tax payments by the National Automated

due date? The use of EFT doesn’t affect the penalties

Clearing House Association (NACHA). Check

and interest applicable to late payments. If you do

with your financial institution to make sure they

not make an EFT payment, or make it late, the same

can transfer your tax payment using this format.

penalties will apply as if you were paying by check.

Before your financial institution can make your

EFT Help/Message Line

payment, you must provide them with the infor-

mation required to complete the ACH CCD+TXP

What services does the EFT Help/Message Line pro-

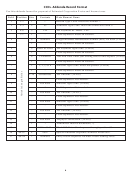

records (i.e., CCD+ Entry Detail Record Format

vide? The EFT Help/Message Line, 503-947-2017,

and CCD+ Addenda Record Format along with

provides complete customer service for using Or-

all the information that goes in these records). The

egon’s EFT program.

record formats for both the CCD+ entry detail and

The EFT Help/Message Line will:

CCD+ addenda records are included in this pro-

gram guide. In order to receive the state’s routing

• Provide you with instructions on how to enroll in

and account numbers you must submit your ACH

the EFT program.

• Answer your questions about using EFT to pay

Credit Agreement and Application and have it

your Oregon estimated corporation excise and

approved by the Department of Revenue. We will

mail you a confirmation letter with our routing

income taxes.

• Direct you to EFT information on our website,

number and designated account number.

The ACH credit program guide and your confir-

mation letter should be taken to your financial

Standard procedures

institution before submitting your first payment.

Once you are registered to participate in our EFT pro-

EFT does not change any existing requirements of

gram, all your payments must be made through EFT.

Oregon state tax law including provisions for un-

In an emergency, a payment coupon may be used;

derpayment of estimated tax. Due dates for paying

however your payment must still be received timely.

Oregon estimated corporation excise and income

Payment due date. Your payment due date will remain

tax are the same as due dates for depositing federal

the same. To be considered timely, your EFT payment

tax. To be considered timely, your tax payment

must be received by the state’s financial institution

must be received by the state’s financial institution

on or before each payment due date. Contact your

by the payment due date. You must check with

financial institution to determine when to initiate your

your financial institution to determine when you

payment to ensure your payments are timely.

should originate your payment so it will be received

on time. The Federal Reserve, which regulates the

Corporate excise tax or corporate income tax? Most

ACH network, does not allow the warehousing of

corporations are subject to corporate excise tax. You

payments for more than two days.

are subject to corporate excise taxes if you are doing

business in Oregon. In other words, if you have an

We strongly recommend that your financial institu-

employee, a building, a warehouse, or a physical

tion process a quality assurance test to validate the

presence in Oregon, then you are subject to corporate

state’s routing number and account number. The

excise taxes.

quality assurance test is a zero-dollar transaction

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11