Form 150-102-042 - Ach Credit Electronic Funds Transfer Program Guide Page 6

ADVERTISEMENT

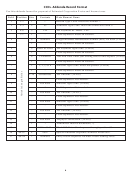

CCD+ Entry Detail Record Format

Field

Position Size

Contents

Data Element Name

1

1–1

1

6

Record Type Code. Insert the number 6.

2

2–3

2

22 or 24

Transaction Code. Enter the number 22 (24 for a pre-note.)

3

4–11

8

Numeric

State’s Routing Number.

4

12–12

1

Numeric

State’s Routing Number Check Digit.

5

13–29

17

Alphanumeric

State’s Account Number (with trailing blanks).

6

30–39

10

$$$$$$$$¢¢

Total Payment Amount. No decimal. Insert leading zeros.

7

40–54

15

Numeric

Oregon Business ID Number (BIN). No dash. Insert leading zeros.

8

55–76

22

Alphanumeric

Receiving Company Name (your business name).

9

77–78

2

Not used

Discretionary Data.

10

79–79

1

1

Addenda Record Indicator. Insert the number one.

11

80–94

15

Numeric

ACH Trace Number.

justified and zero filled. Do not insert a decimal

Field 1—Record Type Code. This field will always be

point. The last two characters are cents.

a 6 for the Entry Detail Record.

Field 2—Transaction Code. This field indicates the

Field 7—Oregon Business Identification Number

(BIN). A numeric field that uniquely identifies the

transaction is a credit and the payment is going to a

taxpayer sending the payment. This field is your

checking account. (This code is “24” when you send

a pre-note.)

(up to nine-digit) Oregon Business Identification

Number (BIN). Its use is essential for your payment

Field 3/4—Receiving Routing Number and Check

to be properly posted. The BIN must be right justi-

Digit. This nine-digit number identifies the state’s

fied and zero filled.

financial institution. The first eight digits go in Field

3. The ninth digit goes in Field 4 (Routing Number

Field 8—Receiving Company Name. The Department

of Revenue recommends that you enter your corpo-

Check Digit). The Department of Revenue will give

ration’s name in this field, for research purposes.

you the receiving routing number in the confir-

mation letter after receiving and approving your

Field 9—Discretionary Data. This two-character field

ACH Credit Agreement and Application.

is not used by the department.

Field 5—Receiving Account Number. This field iden-

Field 10—Addenda Record Indicator. Always insert

tifies the account at the state’s financial institution

the number 1, as there will be an addendum record

where the EFT payments will be sent. This number

with this transaction.

will be given to you by the Department of Revenue

Field 11—Trace Number. A number added to the re-

in the confirmation letter.

cord by the originating/sending financial institution

Field 6—Amount. This field is the amount to be

to trace the transaction through the system. This

posted to the recipient’s account. It must be right

number is especially important in case of an error.

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11