Form 150-102-042 - Ach Credit Electronic Funds Transfer Program Guide Page 8

ADVERTISEMENT

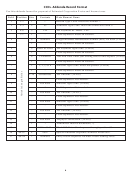

Field 1—Record Type Code. This field will be a 7 for

Field 16—Special Addenda Sequence Number. For

the CCD+ Addenda Record.

the CCD+ format this entry will always be 0001.

Field 2—Addenda Type Code. This field will be a 05

Field 17—Entry Detail Sequence Number. This entry

for the CCD+ Addenda Record.

is the same as the last seven digits of the ACH trace

number (field 11 of CCD+ Entry Detail Record) on

Field 3—Tax Payment ID. This field will be TXP.

the corresponding Entry Detail Record.

Field 4—Business Identification Number (BIN)

(TXP01). This number is your Oregon Business

Revenue holiday schedule

Identification Number (BIN). Its use is essential for

If a payment due date falls on a legal holiday or

your payment to be properly posted. Don’t put the

weekend, the tax payment must be received on the

dash just before the last character in the field. For ex-

first business day after the holiday or weekend.

ample, BIN 104532-6 would be entered as 1045326.

Timely payments are based on the settlement date

Field 5—Tax Payment Type Code (TXP02). This field

(the date on which the funds move between financial

must contain the code for your tax payment. Enter

institutions).

20001 for corporate excise tax or 20201 for corporate

If your financial institution is closed on a day that

income tax.

you wish to initiate your transfer, you must contact

Note: Most corporations are subject to corporate

them one day before the observed holiday.

excise tax. You are subject to corporate excise taxes if

Financial institution holidays in other states may

you are doing business in Oregon. See page 3 under

vary from the holiday schedule listed below. Some

Standard Procedures for more detail.

financial institutions may need 48 hours notice to

Field 6—Year End Date (TXP03). This field must

initiate your transaction.

contain the fiscal or calendar year end date, using

Holiday schedule

the format YYMMDD. Example: A payment with a

year ending date of March 31, 2003 will be entered

New Years Day ...................January 1

as: 030331.

Martin Luther King Day ....Third Monday in January

Presidents’ Day ..................Third Monday in February

Field 7—Amount Type Code (TXP04). This field must

Memorial Day ....................Last Monday in May

contain the quarter (1, 2, 3, or 4) to which you want

Independence Day .............July 4

your estimated corporation tax payment applied.

Labor Day ...........................First Monday in September

Columbus Day ...................Second Monday in October

Field 8—Tax Amount (TXP05). The amount to be

Veterans’ Day .....................November 11

posted to your Estimated Corporation tax account.

Thanksgiving Day .............Fourth Thursday in November

Do not insert a decimal point. The last two characters

Christmas Day ....................December 25

are cents.

When a legal holiday falls on a Sunday, it will be observed

Fields 9–13 (TXP06, TXP07, TXP08, TXP09, and

on the following Monday. When a legal holiday falls on a

TXP10). The Department of Revenue does not use

Saturday, it will be observed either on that day or on the

these addenda record fields for estimated corpo-

preceding Friday.

ration tax payments.

Field 14—Terminator. A backslash (\) must be entered.

Field 15—Blank Fill. Enter blank spaces through po-

sition 83. The next field starts on position 84.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11