Form 150-102-042 - Ach Credit Electronic Funds Transfer Program Guide Page 7

ADVERTISEMENT

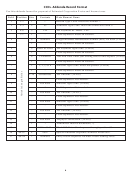

CCD+ Addenda Record Format

Use this addenda format for payment of Estimated Corporation Excise and Income taxes.

Field

Position Size

Contents

Data Element Name

1

1–1

1

7

Record Type Code. Insert the number 7.

2

2–3

2

05

Addenda Type Code. Insert the characters 0 and 5.

3

4–6

3

TXP

Tax Payment ID. Insert “TXP.”

7–7

1

*

Field Separator. Insert an asterisk.

4

9

Numeric

Oregon Business Identification Number (BIN). No dash. (TXP01)

1

*

Field Separator. Insert an asterisk.

5

5

20001 or 20201

Tax Payment Type Code. (TXP02)

1

*

Field Separator. Insert an asterisk.

6

6

YYMMDD

Year End Date. Enter year ending date for this deposit. (TXP03)

1

*

Field Separator. Insert an asterisk.

7

1

1, 2, 3, or 4

Amount Type Code. Enter the quarter. (TXP04)

1

*

Field Separator. Insert an asterisk.

8

1–10

$$$$$$$$¢¢

Tax Amount. (TXP05)

–

*

Field Separator. Not needed.

9

–

Not used

Amount Type Code. (TXP06)

–

*

Field Separator. Not needed.

10

–

Not used

Tax Amount. (TXP07)

–

*

Field Separator. Not needed.

11

–

Not used

Amount Type Code. (TXP08)

–

*

Field Separator. Not needed.

12

–

Not used

Tax Amount. (TXP09)

–

*

Field Separator. Not needed.

13

–

Not used

Taxpayer Verification. (TXP10)

14

1

\

Terminator. Insert a backslash (\).

15

bbbb...bbbb

Blank Fill. Enter blank spaces through position 83.

16

84–87

4

0001

Special Addenda Sequence Number. Enter 0001.

17

88–94

7

Numeric

Entry Detail Sequence Number. Insert leading zeros.

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11