Instructions For Form 8959 - 2016

ADVERTISEMENT

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form 8959

Additional Medicare Tax

Section references are to the Internal Revenue Code

self-employment loss shouldn't be

(including the railroad retirement (RRTA)

unless otherwise noted.

considered for purposes of this tax. Railroad

compensation and tips of your spouse, if

retirement (RRTA) compensation should be

married filing jointly) is greater than the

Future Developments

separately compared to the threshold.

threshold amount for your filing status in the

chart on this page.

Your employer is responsible for

For the latest information about

withholding the 0.9% Additional Medicare

Your Medicare wages include your wages

developments related to Form 8959 and its

Tax on your Medicare wages or railroad

and tips from Form W-2, box 5; your tips

instructions, such as legislation enacted after

retirement (RRTA) compensation paid in

from Form 4137, line 6; and your wages from

they were published, go to

excess of $200,000 in a calendar year. Your

Form 8919, line 6.

form8959.

employer is required to begin withholding

Your self-employment income includes

Additional Medicare Tax in the pay period in

amounts from Schedule SE – Section A,

Reminders

which your wages or compensation for the

line 4, or Section B, line 6. But negative

year exceed $200,000 and continue to

amounts shouldn't be considered for

Missing or incorrect Form W-2. Your

withhold it in each pay period for the

purposes of Form 8959.

employer is required to furnish Form W-2 to

remainder of the calendar year.

If your Medicare wages, railroad

you no later than January 31, 2017. If you

More information. The IRS and the

retirement (RRTA) compensation, or

don't receive your Form W-2 by early

Treasury Department have issued final

self-employment income is adjusted, you

February, see Tax Topic 154 to find out what

regulations (T.D. 9645) on the Additional

may need to correct your liability, if any, for

to do. Tax topics are available at

Medicare Tax. The final regulations are

Additional Medicare Tax. When correcting

taxtopics. Even if you don't get

available at

irb/2013-51_IRB/

Additional Medicare Tax liability, attach a

a Form W-2, you must still figure your

ar10.html. For more information on

corrected Form 8959, to your original return

Additional Medicare Tax. If you lose your

Additional Medicare Tax, visit

or amended return, as applicable. If you are

Form W-2 or it is incorrect, ask your

and enter the following words in the search

correcting Medicare wages or railroad

employer for a new one.

box: Additional Medicare Tax.

retirement (RRTA) compensation, also

Forms W-2 of U.S. Possessions.

attach Form W-2, Wage and Tax Statement,

Who Must File

References to Form W-2 on Form 8959 and

or Form W-2c, Corrected Wage and Tax

in these instructions also apply to Forms

Statement.

You must file Form 8959 if one or more of the

W-2AS, W-2CM, W-2GU, W-2VI, and

following applies to you.

Amounts Subject to

499R-2/W-2PR. However, for Form 499R-2/

Your Medicare wages and tips on any

W-2PR, Medicare wages and tips are

Additional Medicare Tax

single Form W-2 (box 5) are greater than

reported in Box 19 and Medicare tax

$200,000.

withheld is reported in Box 20.

All wages that are subject to Medicare tax

Your railroad retirement (RRTA)

are subject to Additional Medicare Tax to the

compensation on any single Form W-2

General Instructions

extent they exceed the threshold amount for

(box 14) is greater than $200,000.

your filing status. For more information on

Your total Medicare wages and tips plus

what wages are subject to Medicare tax, see

your self-employment income (including the

Purpose of Form

the chart, Special Rules for Various Types of

Medicare wages and tips and

Services and Payments, in section 15 of

Use Form 8959 to figure the amount of

self-employment income of your spouse, if

Pub. 15, Employer’s Tax Guide.

Additional Medicare Tax you owe and the

married filing jointly) are greater than the

amount of Additional Medicare Tax withheld

threshold amount for your filing status in the

Your employer must withhold Additional

by your employer, if any. You will carry the

chart on this page.

Medicare Tax on wages it pays to you in

amounts to one of the following returns.

Your total railroad retirement (RRTA)

excess of $200,000 for the calendar year,

Form 1040.

compensation and tips (Form W-2, box 14)

regardless of your filing status and

Form 1040NR.

Form 1040-SS.

Form 1040-PR.

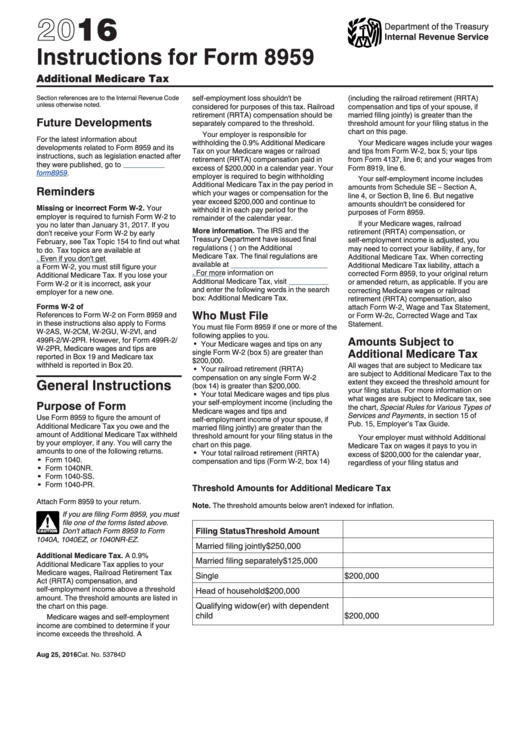

Threshold Amounts for Additional Medicare Tax

Attach Form 8959 to your return.

Note. The threshold amounts below aren't indexed for inflation.

If you are filing Form 8959, you must

file one of the forms listed above.

!

Filing Status

Threshold Amount

Don't attach Form 8959 to Form

CAUTION

1040A, 1040EZ, or 1040NR-EZ.

Married filing jointly

$250,000

Additional Medicare Tax. A 0.9%

Married filing separately

$125,000

Additional Medicare Tax applies to your

Medicare wages, Railroad Retirement Tax

Single

$200,000

Act (RRTA) compensation, and

self-employment income above a threshold

Head of household

$200,000

amount. The threshold amounts are listed in

Qualifying widow(er) with dependent

the chart on this page.

child

$200,000

Medicare wages and self-employment

income are combined to determine if your

income exceeds the threshold. A

Aug 25, 2016

Cat. No. 53784D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4