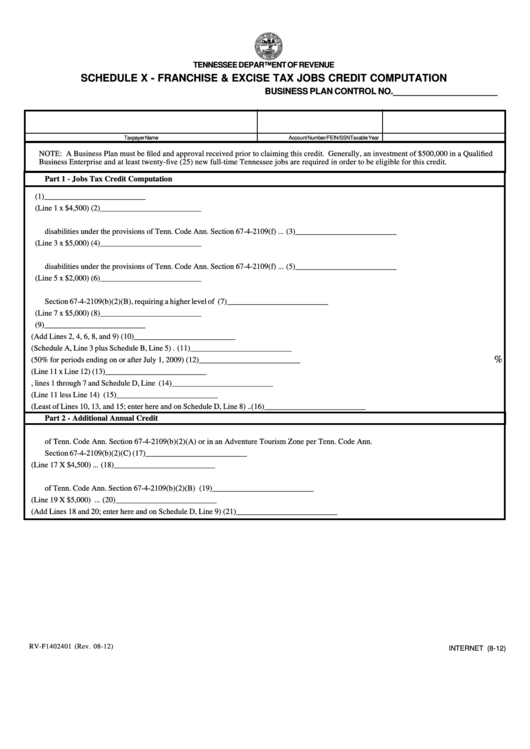

TENNESSEE DEPARTMENT OF REVENUE

SCHEDULE X - FRANCHISE & EXCISE TAX JOBS CREDIT COMPUTATION

BUSINESS PLAN CONTROL NO. ______________________

Taxpayer Name

Account Number/FEIN/SSN

Taxable Year

NOTE: A Business Plan must be filed and approval received prior to claiming this credit. Generally, an investment of $500,000 in a Qualified

Business Enterprise and at least twenty-five (25) new full-time Tennessee jobs are required in order to be eligible for this credit.

Part 1 - Jobs Tax Credit Computation

1. New Tennessee jobs created and filled during the current fiscal year .................................................................. (1) __________________________

2. Jobs Tax Credit from jobs created (Line 1 x $4,500) ............................................................................................. (2) __________________________

3. New full time Tennessee jobs created and filled during the current fiscal year by qualified persons with

disabilities under the provisions of Tenn. Code Ann. Section 67-4-2109(f) ......................................................... (3) __________________________

4. Jobs Tax Credit from jobs created (Line 3 x $5,000) ............................................................................................. (4) __________________________

5. New part time Tennessee jobs created and filled during the current fiscal year by qualified persons with

disabilities under the provisions of Tenn. Code Ann. Section 67-4-2109(f) ......................................................... (5) __________________________

6. Jobs Tax Credit from jobs created (Line 5 x $2,000) ............................................................................................. (6) __________________________

7. New Tennessee jobs created and filled during the current fiscal year under the provisions of Tenn. Code Ann.

Section 67-4-2109(b)(2)(B), requiring a higher level of investment ...................................................................... (7) __________________________

8. Jobs Tax Credit from jobs created (Line 7 x $5,000) ............................................................................................. (8) __________________________

9. Jobs Tax Credit carryover from prior years .......................................................................................................... (9) __________________________

10. Total Jobs Tax Credit available (Add Lines 2, 4, 6, 8, and 9) ............................................................................. (10) __________________________

11. Total Franchise and Excise Taxes (Schedule A, Line 3 plus Schedule B, Line 5) ................................................ (11) __________________________

%

12. Limitation Percentage (50% for periods ending on or after July 1, 2009) ........................................................... (12) __________________________

13. Limitation (Line 11 x Line 12) ............................................................................................................................. (13) __________________________

14. Credit from Schedule D, lines 1 through 7 and Schedule D, Line 9 ..................................................................... (14) __________________________

15. Net Tax before Jobs Credit (Line 11 less Line 14) .............................................................................................. (15) __________________________

16. Total amount available in current year (Least of Lines 10, 13, and 15; enter here and on Schedule D, Line 8) .. (16) __________________________

Part 2 - Additional Annual Credit

17. Jobs qualifying for additional annual credit in Tier 2 and Tier 3 Enhancement Counties under the provisions

of Tenn. Code Ann. Section 67-4-2109(b)(2)(A) or in an Adventure Tourism Zone per Tenn. Code Ann.

Section 67-4-2109(b)(2)(C) ................................................................................................................................. (17) __________________________

18. Additional Annual Credit - Enhancement Counties (Line 17 X $4,500) ............................................................. (18) __________________________

19. Jobs qualifying for additional credit based on a higher level of investment under the provisions

of Tenn. Code Ann. Section 67-4-2109(b)(2)(B) ................................................................................................ (19) __________________________

20. Additional Annual Credit - Higher Investment Level (Line 19 X $5,000) .......................................................... (20) __________________________

21. Total Additional Annual Credit (Add Lines 18 and 20; enter here and on Schedule D, Line 9) ......................... (21) __________________________

RV-F1402401 (Rev. 08-12)

INTERNET (8-12)

1

1 2

2 3

3