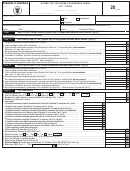

Instructions for Schedule X – Franchise and Excise Tax Jobs Credit Computation

General Information

higher level of investment.

•

Line 8 Multiply the number on Line 7 by $5,000.

Prior approval is required for this credit. In order to receive

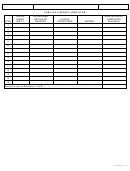

Line 9 Enter the Job Tax Credit carryover from prior years. Please

approval the taxpayer must file a Job Tax Credit Business Plan

include the Job Tax Credit Carryover table.

or a Job Tax Credit for Hiring Persons with Disabilities Busi-

Line 10 Add the amounts from Lines 2, 4, 6, 8, and 9.

ness Plan. Provided all requirements are met, the taxpayer will

Line 11 Enter the total Franchise and Excise taxes shown on page one

be issued a control number.

•

of the return, before credits or payments have been deducted.

In order to qualify for the standard Job Tax Credit the tax-

Line 12 Enter the limitation percentage. The limitation percentage

payer must be a Qualified Business Enterprise as defined in

will generally be 50%.

Tenn. Code Ann. Section 67-4-2109(a)(5). Generally, in order

Line 13 Multiply Line 11 by Line 12.

to be a Qualified Business Enterprise the taxpayer must be

Line 14 Enter the sum of all credits claimed on Schedule D, Lines 1

engaged in manufacturing, warehousing and distribution, pro-

through 7 and Schedule D, Line 9. Industrial Machinery and

cessing tangible personal property, research and develop-

Job Tax Credits are applied last since they have the longest

ment, computer services, call centers, headquarters facilities,

carryover period and it is usually in the taxpayer’s best inter-

as defined in Tenn. Code Ann. Section 67-6-224(b), conven-

est to apply the other credits first.

tion or trade show facilities, or a tourism related business.

Line 15 Subtract Line 14 from Line 11.

This requirement does not apply to the Job Tax Credit for

Line 16 Enter the least of Lines 10, 13, or 15. Also enter this number

Hiring Persons with Disabilities. In order to qualify for the

on Schedule D, Line 8.

standard Job Tax Credit a capital investment of at least $500,000

must be made within the Investment Period. This require-

Part 2

ment does not apply to the Job Tax Credit for Hiring Persons

Line 17 Enter the number of jobs qualifying for the additional annual

with Disabilities.

•

credit in Tier 2 and Tier 3 Enhancement Counties or in an

In order to qualify for the standard Job Tax Credit at least 25

Adventure Tourism Zone. Do not include any jobs on this

net new full-time Tennessee jobs must be created and filled

line that are included in Line 19. See Tenn. Code Ann. Section

within the Investment Period. This requirement does not

67-4-2109(b)(2)(A) and Tenn. Code Ann. Section 67-4-

apply to the Job Tax Credit for Hiring Persons with Disabili-

2109(b)(2)(C) for further information.

ties.

Line 18 Multiply the number on Line 17 by $4,500.

Line 19 Enter the number of jobs qualifying for the additional annual

Line by Line Instructions

credit based on a higher level of investment and job creation

under the provisions of Tenn. Code Ann. Section 67-4-

Control Number. Enter the control number received from the Depart-

2109(b)(2)(B). Do not include any jobs on this line that are

ment of Revenue. If more than one control number has been

included in Line 17.

received, enter the most recent number.

Line 20 Multiply the number on Line 19 by $5,000.

Line 21 Add Lines 18 and 20. Also enter this number on Schedule D,

Part 1

Line 9. The additional annual credit calculated in Part 2 can

Line 1 Enter the number of net new full-time Tennessee jobs created

be used to offset up to 100% of the current year Franchise

and filled during the current fiscal year that do not fall into

and Excise tax liability. Any remaining additional annual credit

one of the categories specifically listed elsewhere on Sched-

is not refundable and cannot be carried forward.

ule X.

Line 2 Multiply the number on Line 1 by $4,500.

Line 3 Enter the number of net new full-time Tennessee jobs created

and filled by persons with disabilities during the current fis-

cal year. Only include employees for whom health insurance

is provided. If health insurance is not provided, the job should

be claimed on Line 5.

Line 4 Multiply the number on Line 3 by $5,000.

Line 5 Enter the number of net new part-time Tennessee jobs cre-

ated and filled by persons with disabilities during the current

fiscal year. Include full-time employees with disabilities for

whom health insurance is not provided.

Line 6 Multiply the number on Line 5 by $2,000.

Line 7 Enter the number of net new full-time Tennessee jobs created

and filled during the current fiscal year under the provisions

of Tenn. Code Ann. Section 67-4-2109(b)(2)(B), requiring a

1

1 2

2 3

3