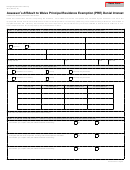

Instructions for Form 2602,

Request to Rescind Principal Residence Exemption

General Instructions

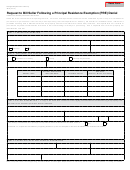

Line 12. If you own and live in a multiple-unit or

multi-purpose property (e.g. a duplex or apartment

This form enables people who are selling or converting

building, or a storefront with an upstairs flat), you can claim

their home to another use to rescind their exemption. It also

an exemption only for the portion that you use as your

enables people to change the percentage that they occupy as

principal residence. Calculate your portion by dividing the

their principal residence.

floor area of your principal residence by the floor area of the

Interest and Penalty. If it is determined that you claimed

entire building.

property that is not your principal residence, you may be

If the parcel of property you are claiming has more than

subject to the additional tax plus penalty and interest as

one home on it, you must determine the percentage that

determined under the Property Tax Act.

you own and occupy as your principal residence. A second

Line-by-Line Instructions

residence on the same property (e.g. a mobile home or second

Lines not listed here are explained on the form.

house), is not part of your principal residence even if it is not

Property Information

rented to another person. Your local assessor can tell you the

assessed value of each residence to help you determine the

Line 1. Property is identified with a property tax

percentage that is your principal residence.

identification number. This number will be found on your tax

If you rent part of your home to another person, you may

bill and on your property tax assessment notice. Enter this

number in the space indicated. If you cannot find this number,

have to prorate your exemption. If your home is a single-family

dwelling and the renters enter through a common door of your

call your township or city assessor. Submit a separate Form

living area to get to their rooms, you may claim 100 percent

2602 for each exemption being rescinded. Your property

exemption if less than 50 percent of your home is rented to

number is vital; without it, your township or city cannot adjust

others who use it as a residence. However, if part of the home

your property taxes accurately.

was converted to an apartment with a separate entrance, you

Lines 2-5. Enter the complete property address of the

must calculate the percentage that is your principal residence,

exemption you are rescinding. Check the appropriate box for

by dividing the floor area of your principal residence by the

the city or township. If you live in a village, list the township

floor area of the entire building.

in which the principal residence is located.

Line 13. Enter the date that the change(s) indicated on lines

Lines 6-10. Enter the name, Social Security Number(s) and

11 and 12 above became effective.

daytime telephone number of the legal owner(s). Do not

Line 14. Select the appropriate box.

include information for a co-owner who does not occupy

Line 15. If this rescission is being done because of a change

the principal residence.

in ownership, list the new owner and, if applicable, co-owner

Note: The request for the Social Security Number is

on the appropriate lines.

authorized under section 42 USC 405 (c) (2) (C) (i). It is used

Certification

by the Department of Treasury to verify tax exemption claims

and to deter fraudulent filings. Any use of the number by

Sign and date the form. Enter your mailing address if it is

closing agents or local units of government is illegal and

different from the address on line 3.

subject to penalty.

Mailing Information

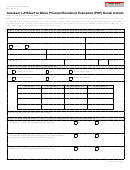

Change an Existing Exemption

Mail your completed form to the township or city assessor in

You are required to rescind a principal residence exemption

which the property is located. This address may be on your

when you no longer own and occupy the property as

most recent tax bill or assessment notice. Do not send this

your principal residence. The exemption will be removed

form directly to the Department of Treasury.

December 31st of the year you rescind the exemption.

If you have any questions, visit

Line 11. Check the box(es) that most accurately reflects

or call (517) 373-1950.

reason you are rescinding your exemption.

1

1 2

2