Instructions For Rct-128c Return

ADVERTISEMENT

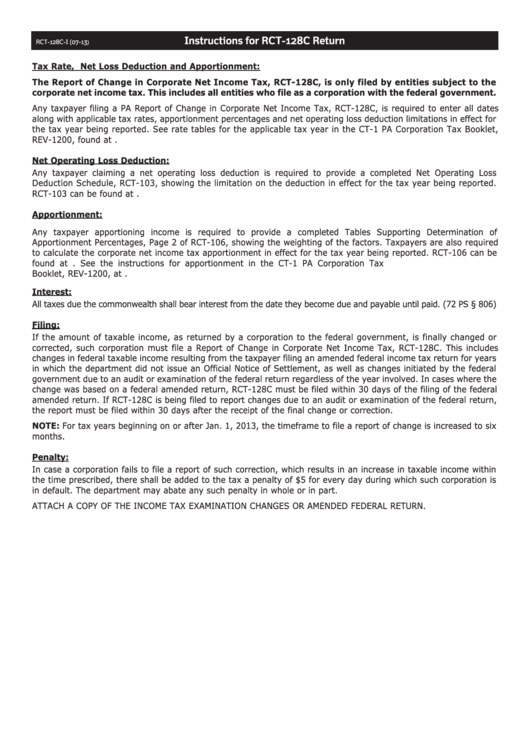

Instructions for RCT-128C Return

RCT-128C-I (07-13

)

Tax Rate, Net Loss Deduction and Apportionment:

The Report of Change in Corporate Net Income Tax, RCT-128C, is only filed by entities subject to the

corporate net income tax. This includes all entities who file as a corporation with the federal government.

Any taxpayer filing a PA Report of Change in Corporate Net Income Tax, RCT-128C, is required to enter all dates

along with applicable tax rates, apportionment percentages and net operating loss deduction limitations in effect for

the tax year being reported. See rate tables for the applicable tax year in the CT-1 PA Corporation Tax Booklet,

REV-1200, found at

Net Operating Loss Deduction:

Any taxpayer claiming a net operating loss deduction is required to provide a completed Net Operating Loss

Deduction Schedule, RCT-103, showing the limitation on the deduction in effect for the tax year being reported.

RCT-103 can be found at

Apportionment:

Any taxpayer apportioning income is required to provide a completed Tables Supporting Determination of

Apportionment Percentages, Page 2 of RCT-106, showing the weighting of the factors. Taxpayers are also required

to calculate the corporate net income tax apportionment in effect for the tax year being reported. RCT-106 can be

found at See the instructions for apportionment in the CT-1 PA Corporation Tax

Booklet, REV-1200, at

Interest:

All taxes due the commonwealth shall bear interest from the date they become due and payable until paid. (72 PS § 806)

Filing:

If the amount of taxable income, as returned by a corporation to the federal government, is finally changed or

corrected, such corporation must file a Report of Change in Corporate Net Income Tax, RCT-128C. This includes

changes in federal taxable income resulting from the taxpayer filing an amended federal income tax return for years

in which the department did not issue an Official Notice of Settlement, as well as changes initiated by the federal

government due to an audit or examination of the federal return regardless of the year involved. In cases where the

change was based on a federal amended return, RCT-128C must be filed within 30 days of the filing of the federal

amended return. If RCT-128C is being filed to report changes due to an audit or examination of the federal return,

the report must be filed within 30 days after the receipt of the final change or correction.

NOTE: For tax years beginning on or after Jan. 1, 2013, the timeframe to file a report of change is increased to six

months.

Penalty:

In case a corporation fails to file a report of such correction, which results in an increase in taxable income within

the time prescribed, there shall be added to the tax a penalty of $5 for every day during which such corporation is

in default. The department may abate any such penalty in whole or in part.

ATTACH A COPY OF THE INCOME TAX EXAMINATION CHANGES OR AMENDED FEDERAL RETURN.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1