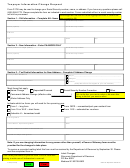

Form 101 - Schedule E2- Jointly Owned Property - Wisconsin Department Of Revenue Page 2

ADVERTISEMENT

INSTRUCTIONS FOR SCHEDULE E2 - JOINTLY OWNED PROPERTY - CONTRIBUTION BASIS

SURVIVORSHIP MARITAL PROPERTY

Report on Schedule E2 all property which does not require

poses, the burden is upon such tenant(s) to establish contri-

the signature of all joint tenants to fully transfer the property

bution. Submit an affidavit from the surviving joint tenant(s)

or terminate the joint tenancy. Examples of such property are

establishing the extent, origin and nature of the contribution

checking and savings accounts, certificates of deposit and

claim.

government bonds, including accrued interest to date of

death. Also, report on Schedule E2 the decedent’s interest in

REPORTING OF PROPERTY:

survivorship marital property. See the instructions to Sched-

ule MP-MARITAL PROPERTY DECLARATION. All other

• Identify the surviving joint tenant(s) for each item

joint property (e.g., real estate, stock, and any other joint

• Government bonds - See instructions for Schedule B

property which requires the signature of all joint tenants to

• Cash accounts - See instructions for Schedule C

fully transfer the property or terminate the joint tenancy) is

reportable on schedule E1.

COMPUTATION OF TOTAL:

Untitled property is presumed to be the sole property of the

List all joint property properly includable on this schedule and

decedent and is reportable on Schedule F - Other Miscella-

extend the full value to the valuation column. Identify the

neous Property. Also use Schedule F to report a decedent’s

surviving joint tenant(s) for each item. Deduct any contribu-

interest in a partnership. Report the decedent’s interest as a

tion claimed on line 4. Enter the taxable amount on line 14B

tenant in common on Schedule A, if real estate. If personal

of page 2, Form 101. If there is survivorship marital property

property, use Schedule B, C, or F, as appropriate.

or a marital property component see the instructions to

Schedule MP - Marital Property Declaration.

The full fair market value of the property is includable for

inheritance tax purposes unless shown that a part of the

NOTE: Unless specifically stated to the contrary, it will be

property originally belonged to the surviving joint tenant(s).

deemed that the FULL VALUE of all joint property has been

included on this schedule for purposes of the DECLARA-

If the surviving joint tenant(s) contends that less than the full

TION of the person(s) signing this return.

value of the property is includable for inheritance tax pur-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2