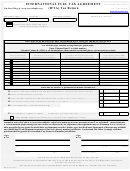

Form Dr 0122 - International Fuel Tax Agreement Tax Report Page 2

ADVERTISEMENT

5. Total

6. Taxable

8. Net Taxable

9. Tax Rate

12. Total

•

7. Tax Paid

10. Tax (8 x 9)

11. Interest Due

•

•

3. Jurisdiction

4. Total Miles

Taxable Miles

Gallons

Gallons (6-7)

(per gallon)

(10 + 11)

Gallons

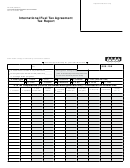

Record the total for each column below.

Enter the total miles traveled in all jurisdictions that are not members of IFTA ........................................................ TOTAL

Type:

Checking

Savings

Routing number

Account number

13. Net Tax DUE (Total Column 10) Note: Enter total net tax amount on Line 13 or 14 (100)

00

14. Net Tax CREDIT (Total Column 10) ...........................................................................(105)

00

Mail to and Make Checks Payable to:

Colorado Department of Revenue,

15. PENALTY ($50.00 or 10% of Column 10, whichever is greater) ...............................

00

Denver, CO 80261-0009

(303) 205-8205

16. INTEREST (Total Column 11) ....................................................................................

00

17. Amount of TAX CREDIT to be refunded this period...................................................

00

18. TOTAL REMITTANCE (A separate check must accompany each return submitted)

Paid by EFT

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check will

$

not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

I certify under penalty of perjury in the second degree that to the best of my knowledge the above information is true and correct.

Signature (Required)

Date (Required)

Title

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3