Form Dr 0122 - International Fuel Tax Agreement Tax Report Page 3

ADVERTISEMENT

IFTA Tax Report

General Information

• Each IFTA licensee must file a quarterly tax report, even if no miles were

separate auxiliary fuel supply tank of highway equipment used for

driven during the calendar quarter.

purposes other than the propulsion engine of the vehicle (i.e. reefer

engine).

• You are required to report all IFTA jurisdictions where you have traveled, even

if the jurisdiction(s) are not printed on the return. Failure to file the return may

• Note: Current fuel tax rates, footnotes, U.S. / Canada exchange rates

result in an assessment of $100 per jurisdiction, plus penalty and interest.

and U.S. / Metric conversions can be found on the IFTA web site at

• IFTA reports are due on the last day of the month immediately following the

end of each tax period. Reports must be postmarked on or before the due

• INCOMPLETE OR INCORRECT RETURNS. Incomplete or incorrect IFTA

date to be considered timely. If the last day of the month falls on a Saturday,

returns will be sent back to the carrier to complete and/or correct. Returns

Sunday or Legal Holiday, the next business day shall be considered the final

sent back for completion or corrections may be subject to late penalties

filing date.

and interest.

• Reports not filed by the due date are considered delinquent. The delinquent

IFTA REMINDERS

Three states have a surcharge on fuel: Indiana, Kentucky, and Virginia. When

penalty is $50.00 or 10% of the tax liability, whichever is greater.

reporting for these states, you must complete both the fuel tax line, and the

• Each fuel type must be reported on a separate tax form. Clear

surcharge line, on the tax return. Fuel purchased at the pump is not allowed on

photocopies of this form will be accepted. Photocopies must show the correct

the surcharge line; the surcharge is not included in the price paid at the pump.

period. A separate check must accompany each return submitted.

You are required to file a quarterly IFTA report even if you have zero (0) miles.

• Each report or copy of report must contain an original signature.

If you have zero (0) miles to report for a quarter, write “0” on lines A through

C, columns 4–12 (only on the C01 line), and lines 13 and 18 of the IFTA tax

• Each licensee shall maintain records for a period of four (4) years

from the filing date of the report to substantiate information reported.

report. A penalty of $50.00 still will be due if the report is submitted late. Be

sure to sign and date the report.

Such records shall be made available upon request by any jurisdiction

member for an audit.

• If you travel in the state of Oregon, you are required to report only the total

miles and total taxable miles, No other information is required for Oregon.

• Bulk fuel users may only take credit for fuel placed into the fuel tank

of a qualified motor vehicle from a licensee’s own bulk storage facility.

• Be sure to mail the IFTA return to the address listed on the reverse side

DO NOT include fuel which remains in the bulk storage tank, has been

of the return. Failure to do so could delay processing of the return, and

result in a delinquency notice for late filing.

dispensed in off-highway equipment or has been dispensed into a

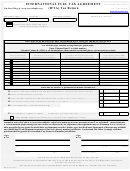

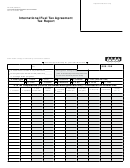

Instructions for Completing the (DR 0122) IFTA Tax Report

Step 1 (Line 1A)

Step 12 (Column 10)

Total all miles traveled during the period and enter the amount on Line 1A. (Be

Multiply column 8 by column 9. Use parenthesis or brackets to indicate credit amounts.

sure to include miles traveled for both IFTA and Non-IFTA jurisdictions). Do not

The amounts in this column must be recorded in dollars and cents (e.g. 12.32).

use decimals (round mileage to the nearest whole mile i.e. 4,231.56 = 4,232).

Step 13

Step 2 (Line 1B)

If your return is being filed after the due date (late) follow instructions for

columns 11 and 12. If the return is filed by the due date proceed to step 14.

Enter the total gallons of fuel placed in the propulsion tank, in both IFTA and non-

IFTA jurisdictions, for all qualified motor vehicles in your fleet using the fuel type

Column 11

indicated (round to the nearest whole gallon i.e. 806.09 = 806).

If the return is filed after the due date, multiply column 10 by the appropriate interest

Step 3 (Line 1C)

rate for each month it is late. Interest accrues monthly at 1/12 the annual rate

Divide the amount on line 1A by the amount on line 1B (round to two decimal places

and does not apply to credit amounts. For return periods that are late after July

i.e. 5.2506 = 5.25).

1, 2013, the annual interest rate is 2 percentage points above the underpayment

rate established under Section 6621(a)(2) of the Internal Revenue Code adjusted

Step 4 (Line 2)

on an annual basis. Interest rate information is available at

Indicate the appropriate fuel type. A separate form is required for each fuel type.

in the IFTA section under ‘How to file’ and at under ‘Interest Rates’.

Step 5 (Column 3)

Column 12

List all IFTA jurisdictions that have miles. Do not list IFTA jurisdictions with zero

Add column 10 and column 11 together when there is interest due. Otherwise,

miles. Use correct jurisdiction abbreviations. Do not list non-IFTA jurisdictions

column 12 will be the same as column 10. The amount must be recorded in

(see step 6 for reporting miles in Non-IFTA jurisdictions).

dollars and cents (e.g. 12.32).

Step 6 (Column 4)

Step 14

List total miles traveled in each IFTA jurisdiction. Do not use decimals (round to

Total the amounts on column 10. If the total is a positive number (tax due) enter

the nearest whole mile). For non-IFTA jurisdictions, enter the total miles traveled

this amount on line 13. If the total is a negative number (credit) enter this amount

in all jurisdictions that are not members of IFTA in the space provided, below the

on line 14. Do not enter an amount on both lines 13 and 14.

column details.

Step 15

Step 7 (Column 5)

If your return is filed on or before the due date, enter “0” on line 15. If your return is

List taxable miles for each jurisdiction. This would be total miles from column 4

filed late; multiply the amount on line 13 by 10% (.10), enter that number or $50.00,

minus any miles paid for while traveling on a fuel tax trip permit in the jurisdiction

which ever is greater on line 15.

that issued the trip permit. Do not use decimals.

Step 16

Step 8 (Column 6)

If your return is filed on or before the due date, enter 0 on line 16. If your return is

Divide column 5 by line 1C. Do not use decimals.

filed late enter the total of column 11 on line 16.

Step 9 (Column 7)

Step 17

Enter the total tax-paid gallons of fuel purchased and placed in the propulsion tank

If there is an amount on line 13, add lines 13, 15 and 16 and enter this amount on

of a qualified vehicle in each jurisdiction. When fuel is withdrawn from bulk storage,

line 18. If the sum of lines 15 and 16 is larger than the amount on line 14, enter the

only report those tax-paid gallons removed for use in your qualified motor vehicles

difference on line 18 (total amount due). If the sum of lines 15 and 16 is smaller

during the reporting period. Fuel remaining in storage cannot be claimed until it is

than the amount on line 14, enter the difference on line 17 (refund). Do not enter

used. Round to the nearest gallon.

an amount on both lines 17 and 18.

Zero tax returns must have lines A, B and C filled in with a zero (0); line 2

Step 10 (Column 8)

(fuel type) marked; columns 4-12 (for CO) filled in with a zero (0) along with

Subtract column 7 from column 6. If column 7 is greater than column 6, use

parenthesis or brackets to indicate credit amounts.

lines 13 and 18.

Step 11 (Column 9)

Required – SIGN AND DATE THE REPORT.

For related information, request the following publications:

Enter the tax rate for each applicable IFTA jurisdiction. The tax rates are provided

FYI Excise 8 International Fuel Tax Agreement

on the letter sent with each quarterly tax report. Do not list Non-IFTA jurisdictions

FYI Excise 10 IRP and IFTA Record keeping Requirements

or IFTA jurisdictions with zero miles.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3