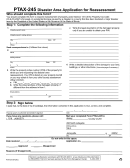

LI

Agree

9.

All owners of income-producing property will be requested to submit income and

Disagree

expense information as provided under N.J.S.A. 54:4-34.

Agree

10.

All applicable approaches to value will be employed in the valuation process, and

Disagree

values developed will be reconciled to determine a final assessed value of the

property as of October 1 of the pretax year.

Agree

11.

A taxpayer orientation program will be conducted to generally describe the

Disagree

reassessment program and its purpose.

Agree

12.

A notice will be sent to all taxpayers to inform them of their proposed assessed value

Disagree

and how an appointment may be made to arrange for an informal review.

Agree

13.

The tax map is up-to-date and has been reviewed and approved by Property

LI

Disagree

Administration within the past three years.

SECTION III

-

HYBRID REASSESSMENT

LI

Place a check mark in this box if any portion of the updating valuation process will be performed

by individual(s) other than the assessor and his or her staff on the municipal payroll.

If you placed a check mark in the above box, a copy of the proposal or contract for the

performance of such services must be attached to this application. Any contract entered into for

valuation of all or a portion of the real property in a municipality is subject to the approval of the

Director of the Division of Taxation (or his/her designee).

SECTION IV

-

CERTIFICATION AND ACKNOWLEDGMENT

I hereby declare as tax assessor that the reassessment will be performed as agreed to and stated in this

application, and any revision or addendum sheet I have attached. I also fully understand that if I am

granted approval to proceed with the reassessment, I will submit monthly reports of the progress and

status of the reassessment to the county tax administrator as prescribed in N.J.A.C. 18:12A-1.14(d).

Check if revision or addendum sheet is attached.

Date

Assessors Signature

******************************************************************************************

The

_______________________

County Board of Taxation at a meeting held on

_______________

20

has thoroughly reviewed the forgoing application and any attached revision or addendum

sheet and recommends

_________________________________

of the proposed reassessment program.

(Approval or Disapproval)

Date

County Tax Administrator

The foregoing proposal for reassessment is hereby approved/disapproved this

___________

day of

_________________

20

,

in accordance with N.J.A.C. 18:12A-1.14(c).

Assistant Director, Division of Taxation

1

1 2

2