Form 43 - Nebraska Public Service Entity Tax Report - 2013 Page 10

ADVERTISEMENT

NEBRASKA SCHEDULE 2 - Supplemental Information

FORM 43

for Use by All Public Service Entities

Attach this schedule and notes to Form 43

Taxable Year

Name and Address as Shown on Form 43

2013

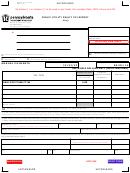

RATE CASE INFORMATION

1

1. Did respondent have a rate change during the previous taxable year?

Yes

No

2. From what regulatory agency? (List each agency in one column)

3. Give docket number of rate case(s)

4. Date rate change(s) went into effect

5. Expected annual change(s) in gross income

6. Expected annual change in net operating income

7. Was there an interim rate increase?

Yes

No

Yes

No

8. Total amount of dollars from rate increases (interim and final)

included in present gross income.

9. Total amount of dollars from rate increases (interim and final)

included in present net operating income

1 A copy of the annual rate case order must be filed at the time of filing the Form 43.

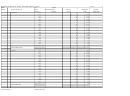

CONSTRUCTION WORK IN PROGRESS BREAKDOWN

1. Short-term revenue producing………………………………………………………

4

2. Long-term revenue producing………………………………………………………

5

3. Amount of construction expected to increase revenues (line 4 plus line 5)..

6

4. Amount of construction devoted to replacement and/or upgrading plant……..

7

5. Amount of construction devoted to replacement of storm damaged plant……

8

6. Total construction work in progress (enter total of line 6 through line 8 )

9

(as reported on balance sheet)

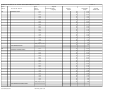

LICENSED MOTOR VEHICLE VALUATION IN NEBRASKA

*Complete this section for motor vehicles licensed in Nebraska only.

Year Acquired

Nebraska Adjusted Basis

Depreciation Factor

Nebraska Net Book Value

2012

85.00

2011

59.50

2010

41.65

2009

24.99

2008

8.33

2007

0.00

Total:

96-162-99 Revised 11/2012

Authorized by Section 77-801

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63