Form 43 - Nebraska Public Service Entity Tax Report - 2013 Page 17

ADVERTISEMENT

NEBRASKA SCHEDULE 5C - Non-Operating Property Leased to Others

FORM 43

for Use by All Public Service Entities

Attach this schedule to Form 43

Taxable Year

Name and Address as Shown on Form 43

2013

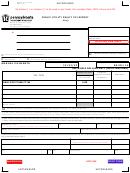

NEBRASKA SCHEDULE 5C - Non-Operating Property Leased to Others

Lessee

Tax Liability

Annual

Leased Property

Annual Rent

LEASE TERM

Type of Property

Name &

Lessor/

Annual Rent

Original Cost

Depreciation

Age

Cost Included in

Included in

Beginning

Expiration

Address

Lessee

Rate Base

Operating Expense

Date

Date

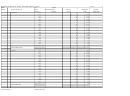

INSTRUCTIONS

Schedules 5C report all non-operating property being leased to other companies or individuals used in the utility operations of a company.

LEASEE:

Provide contact name and address.

LEASED TO OTHERIndicate tax liability in appropriate column. If no indication is made it is assumed the liability is with the lessor.

ORIGINAL COST. Use original cost to the lessor.

DEPRECIATION.

Compute depreciation as it would be if lessor owned the equipment.

96-165-99 Revised 11/2012

Authorized by Section 77-801

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63