Form 43 - Nebraska Public Service Entity Tax Report - 2013 Page 3

ADVERTISEMENT

NEBRASKA PUBLIC SERVICE ENTITY REPORT, INSTRUCTIONS (CONT.)

RECOVERY PERIOD.

Is the period over which the value of property will be depreciated for Nebraska

property tax purposes. The recovery period is the same as the federal Modified

Accelerated Cost Recovery System (MACRS). Reference IRS Publication 534 MACRS

table of assets and associated recovery period in years.

DEPRECIATION.

Is the percentage of the Nebraska adjusted basis that is taxable. Use Table I to find the

appropriate depreciation factor for the recovery period and year acquired.

NET BOOK PERSONAL PROPERTY INSTRUCTIONS

TAXABLE PROPERTY.

All depreciable tangible personal property, except licensed motor vehicles, livestock, and certain

rental equipment which has a Nebraska net book value greater than zero is taxable. Summarize

the property according to the year placed in service and categories indicated by accounts.

PROPERTY TO BE LISTED.

You must list all owned and leased taxable personal property that you own or that you lease from

another person or company. If you are unable to obtain the Nebraska adjusted basis for your leased

property, you must provide a description of the property and the lessor's name and address.

ALLOCATION AND

The company's total taxable net book tangible personal property value will be allocated

DISTRIBUTION OF

to the state, using the same allocation factor established for real property. After allocation the value

TAXABLE VALUE.

is distributed to the counties and their respective taxing subdivisions based on total gross investment

per section 77-802 of the Nebraska Statutes. The net book personal property is not equalized with

real property which is subject to market or ad valorem value.

DETAIL WORKSHEETS

Your company's federal income tax and other depreciation worksheets used in calculating the

SUBJECT TO REVIEW

Nebraska adjusted basis and taxable values are subject to audit and review by the Property Tax

AND AUDIT.

Administrator for up to three years.

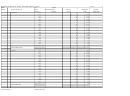

TABLE 1 - Nebraska Net Book Depreciation Factors

RECOVERY PERIOD IN YEARS

Year

3

5

7

10

15

20

2012

75.00%

85.00%

89.29%

92.50%

95.00%

96.25%

2011

37.50

59.50

70.16

78.62

85.50

89.03

2010

12.50

41.65

55.13

66.83

76.95

82.35

2009

0.00

24.99

42.88

56.81

69.25

76.18

2008

8.33

30.63

48.07

62.32

70.46

2007

0.00

18.38

39.33

56.09

65.18

2006

6.13

30.59

50.19

60.29

2005

0.00

21.85

44.29

55.77

2004

13.11

38.38

51.31

2003

4.37

32.48

46.85

2002

0.00

26.57

42.38

2001

20.67

37.92

2000

14.76

33.46

1999

8.86

29.00

1998

2.95

24.54

1997

0.00

20.08

1996

15.62

1995

11.15

1994

6.69

1993

2.23

1992

0.00

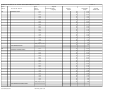

EXAMPLE:

Your company purchases a piece of equipment for $10,000 in tax year 2012. The equipment has a recovery period

of 7 years. The net book personal property value for tax year 1 (2012) is determined by applying the original

cost by the appropriate recovery factor. $10,000 x 89.29% = 8,929.00

Net Book

Taxable

Year

7

Original Cost

Value

1

89.29% 10,000.00

8,929.00

2

70.16 10,000.00

7,016.00

3

55.13 10,000.00

5,513.00

4

42.88 10,000.00

4,288.00

5

30.63 10,000.00

3,063.00

6

18.38 10,000.00

1,838.00

7

6.13 10,000.00

613.00

8

0.00 10,000.00

0.00

3

96-159-99 Revised 3/2013

Authorized by Section 77-801

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63