Form 43 - Nebraska Public Service Entity Tax Report - 2013 Page 6

ADVERTISEMENT

Nebraska Public Service Entity Report

FORM 43

* Must be postmarked by April 15, 2013

*Read instructions and complete enclosed schedules

Tax Year

*Attach copy of your federal annual report

2013

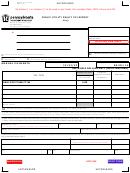

NAME AND LOCATION ADDRESS

Business Name

Nebraska I.D. Number

Street Address

Federal I.D. Number

City

State

Zip Code

NAME AND MAILING ADDRESS

Business Name

Street Address

City

State

Zip Code

Person to Contact Concerning this Report

Name

Title

Mailing Address

E-mail:

Telephone

Fax Number

Person to Whom the Property Tax Statement Should be Sent (if different from above)

Name

Title

Mailing Address

E-mail:

Telephone

Fax Number

Person to Whom the Public Service Entity Value Distribution Report should be Sent (if different from above)

Name

Title

Mailing Address

E-mail:

Telephone

Fax Number

Under penalties of law, I declare that as officer or preparer I have examined this report, including accompanying

schedules and notes, and to the best of my knowledge and belief, it is correct and complete. If filing electronicly, original copy

this form will be filed with the Nebraska Department of Revenue Property Assessment Division.

sign

here

Signature of Officer

Signature of Preparer Other than Officer

Title

Address

Date

Date

I authorize the exchange of information for this return, via e-mail to the e-mail address.

Signature and title of owner, officer, or authorized agent. _____________________________ Title ________________________

Mail completed reports and schedules to: Nebraska Department of Revenue, Property Assessment Division

301 Centennial Mall South, P.O. Box 98919, Lincoln, NE 68509-8919

Email completed reports and schedules to: pat.psu@nebraska.gov

1

96-160-99 Revised 11/2012

Authorized by Section 77-801

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63