Form 43 - Nebraska Public Service Entity Tax Report - 2013 Page 54

ADVERTISEMENT

FORM 43

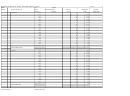

NEBRASKA SCHEDULE 43 - DETAIL NET BOOK PERSONAL (CONT.)

EXAMPLE:

Your company purchased a piece of equipment for $10,000 in tax year 2012. The equipment has a recovery period of 7 years.

The net book personal property value for tax year 2012 is determined by applying the original cost by the appropriate recovery

factor. $10,0000 x 89.29% = $8,929.

TABLE 1 - Nebraska Net Book Depreciation Factors

RECOVERY PERIOD IN YEARS

Year

3

5

7

10

15

20

1

75.00%

85.00%

89.29%

92.50% 95.00% 96.25%

2

37.50

59.50

70.16

78.62

85.50

89.03

3

12.50

41.65

55.13

66.83

76.95

82.35

4

0.00

24.99

42.88

56.81

69.25

76.18

5

8.33

30.63

48.07

62.32

70.46

6

0.00

18.38

39.33

56.09

65.18

7

6.13

30.59

50.19

60.29

8

0.00

21.85

44.29

55.77

9

13.11

38.38

51.31

10

4.37

32.48

46.85

11

0.00

26.57

42.38

12

20.67

37.92

13

14.76

33.46

14

8.86

29.00

15

2.95

24.54

16

0.00

20.08

17

15.62

18

11.15

19

6.69

20

2.23

21

0.00

i

96-184-99 Revised 3/2013

Authorized by Section 77-801

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63