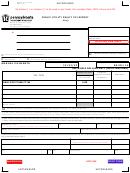

Form 43 - Nebraska Public Service Entity Tax Report - 2013 Page 58

ADVERTISEMENT

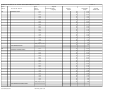

Nebraska Schedule 44 - Cont.

FORM 43

FORM 1

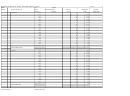

Total Original Cost

Accumlated Depreciation

Depreciated Cost

Recovery Period

Net Book Taxable Value

ACCOUNT TITLE

ACCT. NO.

GENERAL PLANT

392

75

Office Furniture and Equipment

393

76

Stores Equipment

394

77

Tools, Shop and Garage Equipment

395

78

Laboratory Equipment

396

79

Power Operated Equipment

397

80

Communication Equipment

398

81

Miscellaneous Equipment

399

82

Other Tangible Property

83

TOTAL Tangible Personal Property

(Sum Lines 37 - 83)

Percentage Tangible Personal Property (divide Total Original Cost Personal Property (Line 83) by Original Cost all Property)(Line 5) %

%

III. MOTOR VEHICLES

392

84

Transportation Equipment

Percentage Motor Vehicles (divide Total Original Cost Motor Vehicles (Line 84) by Original Cost all Property (Line 4) %

%

INSTRUCTIONS:

This Schedule will be used to determine the % of tangible personal property. The deduction for the actual value of tangible personal property from the

public service entity's unit value shall be based on a factor representing the company's gross book personal property divided by the gross book of their

operating property, as determined from its balance sheet or regulatory reports.

This original cost on this Schedule must conicide with the Balance Sheet figures on Nebraska Schedule 41.

The original cost on this Schedule must conicide with the Nebraska Schedule 43 Net Book Personal Property Schedule.

96-184-99 Revised 3/2013

Authorized by Section 77-801

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63